Spain is not a gas producing country, but it is called to be a pillar of the new gas distribution system consumed by Europeans. Until now Russia controlled the board, with countries of the stature of Germany depending on more than 50% of its shipments, a commercial relationship that as a result of the invasion of Ukraine has been dynamited.

The main objective is to reduce energy dependence as much as possible. A plan that would take years of work but that, given the current scenario, urgently needs to be implemented for next winter. And this is where Spain could play a key role as the region’s ‘energy lifeline’, beyond contributing to the Brussels target of reducing its gas consumption by 15% between now and next spring.

Spain’s great asset in the new distribution map that is coming up is its enormous storage capacity, thanks above all to the six liquefied natural gas (LNG) regasification plants currently operating in the country (Barcelona, Bilbao, Cartagena, Huelva , Mugardos and Sagunto).

In fact, Spain is the country with the largest number of regasification plants in the EU. And the third in the world, only behind Japan and Korea.

Location of regasification plants and international connections

Number of tanks and capacity

* It is expected to resume activity

early 2023

Liquefied natural gas (LNG) storage capacity

Contribution of each regasification plant to the system

Location of regasification plants and international connections

Number of tanks and capacity

* It is expected to resume activity

early 2023

Liquefied natural gas (LNG) storage capacity

Contribution of each regasification plant to the system

Location of regasification plants and international connections

Number of tanks and capacity

The Musel

300,000 m3

(idle*)

* It is expected to resume activity

early 2023

Contribution of each regasification plant to the system

Location of regasification plants and international connections

Number of tanks and capacity

The Musel

300,000 m3

(idle*)

* It is expected to resume activity

early 2023

Contribution of each regasification plant to the system

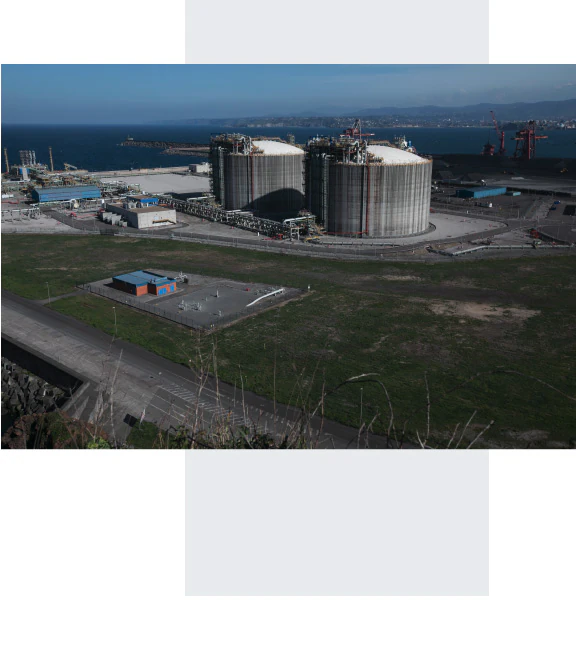

In total, our country represents 44% of the storage capacity of the entire region, without yet having the El Musel plant, whose start-up is expected by the end of this year or the beginning of 2023, with which They will add another 300,000 cubic meters of LNG to the system.

Currently, and according to data from Enagás, the plant with the greatest storage capacity is the one in Barcelona, with six tanks that share 760,000 cubic metres, although the ones that contribute the most to the system are those in Bilbao and Cartagena, accounting for 21% and 20% on the total.

Enagas regasification plant in El Musel, currently inactive. Jorge Peteiro/EUROPA PRESS

Enagas regasification plant in El Musel, currently inactive. Jorge Peteiro/EUROPA PRESS

Enagas regasification plant in El Musel, currently inactive. Jorge Peteiro/EUROPA PRESS

Enagas regasification plant in El Musel, currently inactive. Jorge Peteiro/EUROPA PRESS

Although the figures vary from day to day, the total stocks in the 20 tanks that make up the six operating plants are already around 84% (to which underground storage should be added). In other words, Spain already exceeds the 80% storage target that Brussels had set itself to achieve before November 1.

In total, Spain represents 44% of the storage capacity of the entire region, without yet having the El Musel plant

With these figures, the national supply is guaranteed. But the key is in the use of plants to increase export power. We must bear in mind that the path that LNG travels until it reaches our borders is complex.

It is transported in huge methane tankers – capable of transporting between 100,000 and 250,000 cubic meters of LNG – which have almost absolute flexibility. They can even change course mid-voyage to unload elsewhere if they so choose.

In total, Spain receives this gas in liquid form from 14 different countries, reinforcing imports after the war in Ukraine, especially from the US, which has become our main ‘supplier’, accounting for 32.9% of the total between January and June, according to data provided by Enagás.

The five big suppliers

Data from January to July 2022 with natural gas and liquefied natural gas

The five big suppliers

Data from January to July 2022 with natural gas and liquefied natural gas

The five big suppliers

Data from January to July 2022 with natural gas and liquefied natural gas

The five big suppliers

Data from January to July 2022 with natural gas and liquefied natural gas

That gas that arrives in the methane tankers at 160 degrees Celsius below zero in a liquid state, is discharged in the regasification plants and, through a physical process that uses seawater vaporizers, its temperature is increased. Thus, it is transformed back into gaseous so that it can be injected and subsequently transported through the gas pipeline network.

And here comes the great challenge for Spain. In order for the country to function as an alternative to the Nord Stream I and II gas pipelines coming from Russia, there should be a good connection between our country and the rest of Europe, through France.

Gas system configuration

Extraction

Natural gas (NG) is extracted from deposits through production wells

Transport

of GN

NG is transported in gas pipelines

Liquefaction

It turns into a liquid state (LNG) to reduce its volume

LNG transport

It goes on ships to the regasification plants

Regasification

LNG returns

to its original gaseous state

Storage

Will be drawn to adjust offer

and demand

Distribution

It is consumed in power generation plants, industries, businesses and homes

Gas system configuration

Extraction

Natural gas (NG) is extracted from deposits through production wells

Transport

of GN

NG is transported in gas pipelines

Liquefaction

Turns to liquid state (LNG)

to reduce its volume

LNG transport

It goes on ships to the regasification plants

Regasification

LNG returns

to its original gaseous state

Storage

Will be drawn to adjust offer

and demand

Distribution

It is consumed in power generation plants, industries, businesses and homes

Gas system configuration

Extraction

Natural gas (NG) is extracted from deposits through production wells

LNG transport

It goes on ships to the regasification plants

Regasification

LNG returns

to its original gaseous state

Liquefaction

Turns to liquid state (LNG)

to reduce its volume

Transport

of GN

NG is transported in gas pipelines

Storage

Will be drawn to adjust offer

and demand

Distribution

It is consumed in power generation plants, industries, businesses and homes

Gas system configuration

Extraction

Natural gas (NG) is extracted from deposits through production wells

LNG transport

It goes on ships to the regasification plants

Regasification

LNG returns

to its original gaseous state

Liquefaction

Turns to liquid state (LNG)

to reduce its volume

Transport

of GN

NG is transported in gas pipelines

Storage

Will be drawn to adjust offer

and demand

Distribution

It is consumed in power generation plants, industries, businesses and homes

Just a week ago, German Chancellor Olaf Scholz defended the start-up of a gas pipeline between Spain and France that would make it possible to increase the shipment of gas from the Iberian Peninsula to Central Europe. Knowing its storage capacity and export potential, Spain welcomed the proposal and the third vice president, Teresa Ribera, assured that the Spanish section could be ready in just “eight or nine months.”

Currently, the only gas connection that Spain has with France is a double gas pipeline that runs under the western part of the Pyrenees, one in Irún and the other in the Navarrese Pyrenees. Between the two they can hardly export 8,000 million cubic meters a year, while the so-called Midcat could double that shipment volume.

In addition, transport through these infrastructures is much cheaper than through methane tankers. “With the methane tanker, the cost of transport is between 20% and 30% higher because it involves more processes that are not necessary with a gas pipeline,” explains Roberto Scholtes, investment manager for UBS in Spain.

plant pipelines

of Enagás regasification in Barcelona. AFP

plant pipelines

of Enagás regasification in Barcelona. AFP

plant pipelines

of Enagás regasification in Barcelona. AFP

plant pipelines

of Enagás regasification in Barcelona. AFP

From the Ministry of Ecological Transition they remember that this infrastructure has been on the Commission’s table “for decades”. But the project was paralyzed in 2019 after having invested 440 million euros in it. Among the reasons, its high cost and the commitment to renewable energies.

Since the outbreak of the war, talks have resumed and Spain proposes that Europe help finance the construction of the 200 kilometers that remain unfinished between Hostalric (Girona) and the French town of Barbaira.

But the big obstacle for Midcat is France again, which argues that such a project would take “several years” to be operational, which would not solve the current crisis. In addition, they assure that building a new gas pipeline would defeat the objectives of combating climate change. “Our goal is to do without fossil fuels by 2025, which means reducing our gas consumption by accelerating the development of carbon-free energies,” they explain.

“Connections between states are a matter of European politics. Building Europe goes through the common commitment in terms of energy and infrastructures»

Theresa Rivera

Minister of Ecological Transition

Faced with this situation, Minister Ribera asked the European Commission this week for its “maximum involvement”. “Interconnections between states are a matter of European policy,” she noted. She recalled that France is asking its neighbors for energy, so the country should understand that “building Europe goes through the common commitment of energy and infrastructure policies.”

Even the opposition is putting pressure on Europe. In a parliamentary question to the Community Executive, spokesperson for the Popular Party in the European Parliament, Dolors Montserrat, called again last Thursday for the European Commission to bet on the MidCat gas pipeline that could connect Spain with the rest of Europe and to explain in what time period do you foresee that it could be working.

“You have to bet on renewables, but also react quickly to an energy crisis that can drag on over time,” said Montserrat, while pointing out that the EU has included gas and nuclear energy in its list of green energies to the energy transition.