2024-05-05 23:12:36

[신성장엔진 아시아 뉴7]

POSCO INTER, operating profit of KRW 26.7 billion in the first quarter

Demand for aviation fuel is expected to increase beyond the food industry

Temperature 33 degrees, humidity 86%.

On the morning of the 23rd of last month, the palm farm in Merauke County, Papua, of POSCO International’s Indonesian Palm Business Corporation (PT BIA). Even though I was standing still at the farm, located 7 degrees from the equator (7.08 degrees south latitude), sweat poured down my entire body like rain. Although it is harsh on humans, palm trees only grow in this environment. Most of the fruits on the 3.475 million trees planted here were ripe and red in color. It was a signal that it was the biggest harvest season of the year for palm farms.

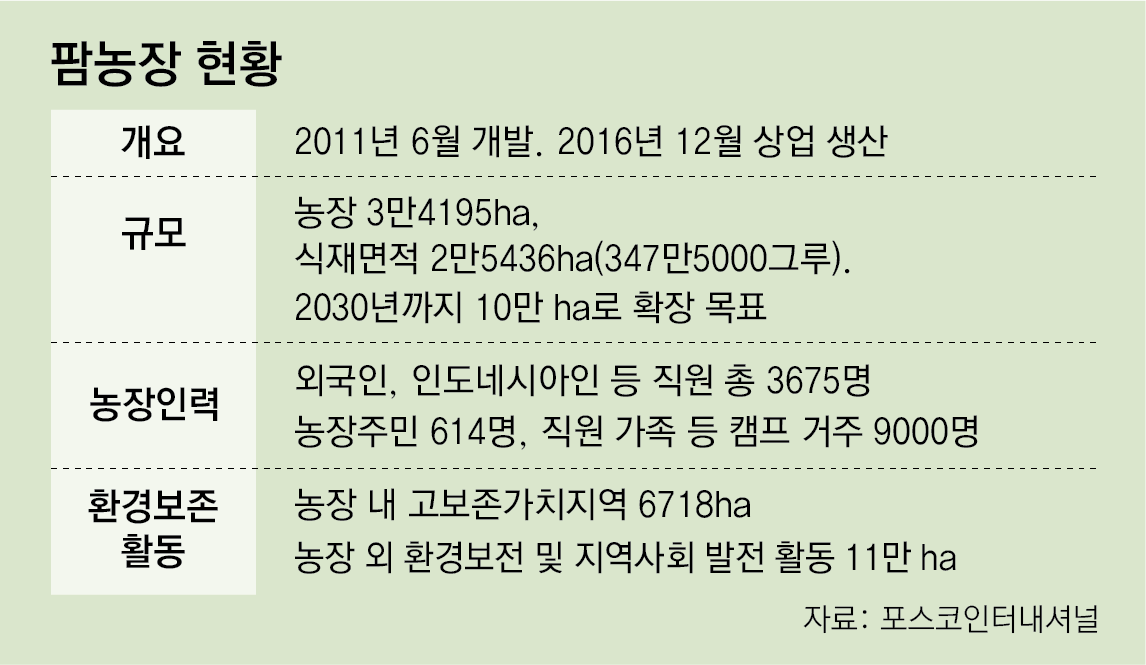

The palm farm is located on Papua Island, the easternmost island in Indonesia, a country with many islands. It is located 265km north of Mopa International Airport at the bottom of Papua Island. The size is approximately 34,200 ha, which is almost half of Seoul.

Palm oil is widely used in the food industry, including cooking oil, snacks, and ramen. It is a promising field that is expected to be used as biofuel such as aviation fuel in the future. POSCO International has been developing this barren land, which had no proper access road, since June 2011 to enter this market.

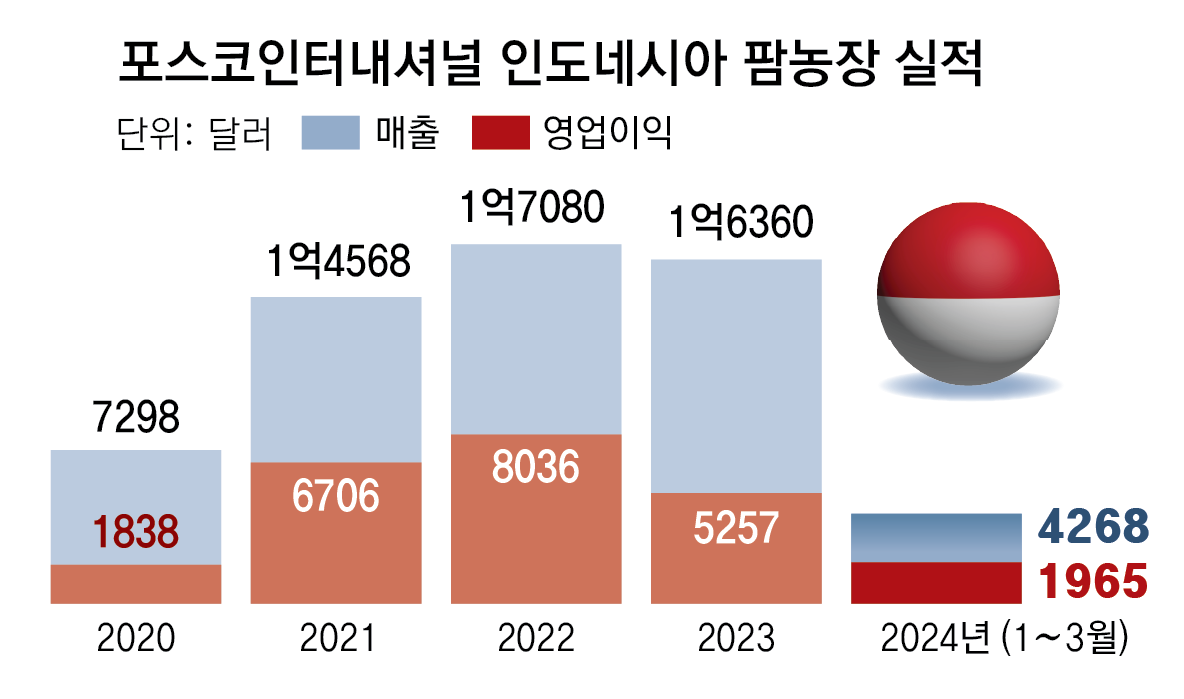

About 10 years later, the palm farm was transformed into a ‘golden land’ that generated an annual operating profit of more than $50 million (about 68 billion won). In 2022, when raw material prices soared in the aftermath of the novel coronavirus infection (Corona 19), the operating profit of palm farms recorded $80.36 million (about 109.3 billion won), the highest ever. Operating profit in the first quarter of this year (January to March) continued to perform well, reaching $19.65 million (about 26.7 billion won). PT BIA CEO Kim Won-il said, “In Indonesia, the world’s largest palm oil producer, our silent efforts with an eye on the future are bearing fruit.”

Palm oil in the jungle is an annual cash cow of 68 billion won, and exports are expanded by building a refinery.

〈8〉 POSCO Inter, the fruits of 10 years of investment

Developing our own port and transport route

After going through a period of rising raw material prices, it became a ‘bonanza’.

“Big growth due to increased demand for bio-jet fuel… “We will increase production efficiency with AI AgTech.”

It takes about 5 hours by car to travel from Mopa International Airport on Papua Island, east of Indonesia, to the palm farm. The two-lane road surrounded by tropical rainforest was ruined in places due to recent rain. When passing on the fragmented asphalt road, the cars bounced like startled elk. Because there was no communication facility, cell phones continued to be ‘unusable’. Kim Jae-won, purchasing manager (manager) of Indonesian Palm Business Corporation (PT BIA), who participated in the development of the farm, said that the situation is much better than before. “It took over 12 hours by car when there were only dirt roads. It’s still dangerous to go outside the farm at sunset. I can’t contact you, and if it rains, I have to worry about survival. “It was a place like this, so when we first announced our business plan, there were bound to be a lot of people who were skeptical.”

● Investment anticipated for growth, fruitful results after 10 years

When POSCO International first tried to start the palm business 13 years ago, there were many opinions in the market that it would fail. The biggest problem was that it took a long time to monetize due to poor infrastructure. Palm trees usually reach their maximum fruit productivity 7 years after planting and can be sold in large quantities.

POSCO International built its own port upstream of the Digul River, about two hours away from the farm, and paved the way to transport crude palm oil (CPO). By reclaiming land close to the port, the planting area was expanded to 25,436 hectares. To reduce damage from rain, a wide road was built in the east-west direction where sunlight shines well.

PT BIA divided the area into three districts (A, B, C) (21 divisions, 1,020 blocks) and provided residential, educational, and medical facilities for each district where farm employees and their families live. Communication blind spots within the farm are also being reduced through Starlink, SpaceX’s satellite internet service. The farm has now become a huge village where about 9,000 people live.

Since 2020, when raw material prices rose, palm farms have been reborn as POSCO International’s ‘cash cow’ (source of profit generation). The price of CPO, which was around $700 (approximately KRW 950,000) per ton in 2017 when commercial production at palm farms took its first step, has soared to a maximum of $1,990 (approximately KRW 2.7 million) in 2022. PT BIA’s annual sales and operating profit for three consecutive years from 2021 to last year were more than $50 million (approximately KRW 68 billion).

● Introducing the latest technology and management techniques to improve productivity

PT BIA CEO Won-il Kim has been focusing his efforts on improving production efficiency since taking office as head of the company at the end of last year. Performance management indicators that check the percentage of immature fruits were introduced starting this year. ‘Sap Plow Sensing (SAP)’, which manages the condition of trees by measuring the speed of internal sap, and ‘AgTech (applying cutting-edge technology to agricultural production)’, which determines maturity using artificial intelligence (AI) when you take a photo of fruit with your mobile phone. Introduction is also being considered.

This is a strategy to overcome the increasingly difficult challenges in Indonesia’s palm business. The Indonesian government announced a ‘forest moratorium’ in 2019 that permanently blocks new permits for logging of natural forests. In 2020, POSCO International became the first Korean company to declare ‘NDPE (No Deforestation, Peat, Exploitation)’, meaning that it will not engage in additional land reclamation. We plan to expand the planting area to 100,000 ha by 2030 by acquiring existing farms, but it is difficult to expand the farm as rapidly as before.

The age of palm trees planted between 2012 and 2017 has already reached its peak fruit production period (7 to 18 years), so systematic management and introduction of management techniques are necessary to further improve productivity. CEO Kim said, “Every time the milking rate (CPO production compared to input palm fruit) increases by 1%, annual profit increases by $6.5 million (approximately KRW 8.8 billion). In the first quarter of this year, we raised this to 26.4%, the highest ever.” “Our goal is to conduct more efficient and eco-friendly management than other industry-leading competitors.”

● Towards the world’s largest palm production base…

POSCO International plans to begin construction of a CPO refining plant on Kalimantan Island in central Indonesia within this year. Samsung C&T (trading division) and LX International, which started the palm business by acquiring local farms in 2008 and 2009, respectively, also began to expand their business by carrying out eco-friendly certification (RSPO) and social contribution activities in line with Indonesia’s strengthening environmental regulations. This is because the growth potential of the Indonesian palm business is highly evaluated.

Palm oil, which has a productivity per area of more than 10 times that of vegetable oils (oils and oils) made from other raw materials such as sunflower seeds and corn, is used not only for cooking oil but also for consumer goods such as cosmetics, pharmaceuticals, and energy raw materials. As of 2022, Indonesia’s annual palm oil production ranked first in the world at 45.58 million tons, of which 27.76 million tons (60.9%) was exported to India, China, and the United States.

The Organization for Economic Co-operation and Development (OECD) and the Food and Agriculture Organization of the United Nations (FAO) predict that global demand for vegetable oils, including palm oil, in 2031 will be 248.7 million tons, up 11.3% from 2022 (223.5 million tons). did. CEO Kim said, “Once the refinery is completed next year, in addition to selling the current CPO to local refinery companies, we will be able to discover more diverse sales partners in the international market.” He added, “In particular, as demand for bio-jet fuel surges, we will see even greater growth in the future.” “It appears that this will come true,” he said.

Merauke = Reporter Kim Jae-hyung monami@donga.com

2024-05-05 23:12:36