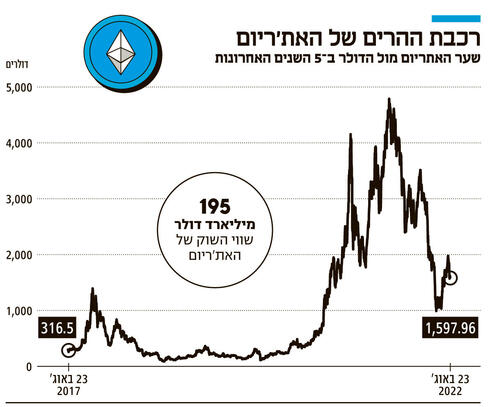

In the crypto market, everyone is talking these days about the Ethereum network merger. This is an upgrade of the world’s most popular blockchain network, and the merger is expected to take place on the night between September 15 and 16, US time. On that night, the blockchain that has served the network since 2015 and is named Mainnet, is expected to merge with a separate blockchain created in 2020, named Beacon. After the merger, the transaction verification method is expected to change and apparently create a more secure and energy efficient system. It is still unclear if the upgrade will actually take place and what its long-term consequences will be.

Ethereum was proposed in 2015 by Vitalik Buterin, who built it with Gavin Wood and Geoffrey Wilkie. The innovation was its ability to run “smart contracts”, that is, programs that are automatically activated under predefined circumstances. The fee that the network requires is paid in the Ether currency (ETH ), which is received by the miner (the computer) who approves the transactions and other operations. The transaction processing capacity of the network is relatively low compared to the traditional financial system, but the popularity is very high and therefore the commission fees (called gas) are even higher in it than in the Bitcoin blockchain.

Ethereum developers have always claimed that it is an unfinished experimental network. In a leaked Skype conversation between them a few years ago, they even admitted that it would take the network “years+” to reach functionality. This network, just like Bitcoin, is notorious for its “scaling” problem, that is, the difficulty of growing exponentially and serving huge audiences that need to perform millions of operations on it. The popularity of the network today means that it cannot operate without friction, it clogs up and becomes slow, expensive and cumbersome and in the process consumes huge amounts of energy. The solution that has been talked about for years is changing the method of proof.

Today the proof method of Bitcoin and Ethereum is called “proof of work” – proof of work or PoW. The method was invented in the 90s of the last century, and is based on the ability of the users of that network to prove that they have completed a computational task. The randomly selected winner validates a new block in the chain, creating a cryptographic link between current and previous blocks. In return, he receives new crypto-currencies (an operation known as mining). With the combined efforts of many miners, the blockchain is kept secure. In this process, a lot of electricity is invested to run the computers competing to solve the computational task.

There is a relatively broad consensus that this method is ineffective. Since 2011, they have been working on an alternative method known as “proof of risk” – Proof of Stake (or PoS). to download the required computational resources. This idea changes the game and the transaction verifier is replaced and is no longer randomly selected from the pool of “who has the most computational power”, to the pool of “who has the most crypto”. To participate in the verification, all a user needs to show is holding a certain amount of Ether that is “locked” or “blocked” in a specific contract – at least 32 coins (about $50,000 in current value). Only those who deposit these assets in a process known as staking, can be randomly selected to verify the block and win a commission. Those who act maliciously or carelessly may lose their coins. The idea behind the move is that the validators will not be just a few large individual players, but that pools will be formed with a large number of participants who will agree to lock their coins to receive their proportional share of the validation fees.

If such reserves are indeed established – the risk of the system becoming centralized will decrease and the risk of what is known as the 51% attack will also decrease. This is an imagined event where one player (or a consortium of players) owns more than 50% of the mining power in the network, and can therefore change it as they see fit. To reach such a situation one user would have to actually own half of all ether in the system, which is about 100 billion dollars in assets, a much less likely possibility than owning more than 50% of the mining power. Passing this proof method will stop the arms race for “computing power” in a nutshell, and will dramatically reduce the notorious energy waste of the crypto market. According to estimates, the Ethereum network today emits carbon dioxide on a scale similar to that of Denmark, with the change expected to reduce electricity consumption by approximately 99.95%.

The merger in question is the moment when proof of risk will become consensus on the Ethereum network. This moment has been promised and postponed several times in the past due to its complexity. The reason it is being taken more seriously this time is that on August 10, an advanced stress test was successfully completed, and the Ethereum Foundation announced a merger date.

The reason this event is called a “merger” and not an “upgrade” or “software update”, although it is definitely a software upgrade, is to emphasize careful archival preservation. With the combination of the two blockchain chains, all the history that exists today in the network will be preserved – all coins, holdings and transactions will remain as they are. Users are not expected to see any change in the coins or other assets (whether they be NFTs or other coins) in their hands. The difference is that mining will no longer be the means of producing blocks, and instead predefined validators will be responsible for validating and validating a block. This means that the many miners who exist for this network, who until today have invested a lot of capital to purchase servers, graphic cards, cooling means, maintenance and electricity bill payments in order to be relevant in the mining process, will find themselves without a source of income. These miners will have several options – to migrate to the merged network and deposit assets to become approved verifiers, to mine other coins or to continue being miners for the Mainnet network – de facto not cooperating with the upgrade.

But the net will not fall to me empty handed. Since 2020 and the creation of the Beacon, various users have been depositing assets to be authenticated to the network. These verifiers will not be able to withdraw their deposits immediately after the merger in order not to damage the network and they are obliged to leave them there for many months after the merger is completed. Contrary to popular estimates, the move is not expected to reduce fees on the network or make it faster. However, Butrin believes that this merger will lay the foundation for a series of upgrades that will allow the network to handle a much larger volume of transactions in the coming years (from 30 transactions per second to 100,000 transactions). All this is, frankly, a theory. The network developers have been working on this upgrade for years and are not implementing it because it is quite difficult. There are thousands of active projects on the Ethereum network today, upgrading the system in such a fundamental way, if not done well, can lead to a huge loss of value for many developers and entrepreneurs. In the community, it is customary to compare the incident to changing the engine of an airplane during flight.

What does the upgrade mean for the other systems, including Bitcoin which still uses PoW? Not much. Bitcoin is a relatively conservative system. The hard core of this community does not usually deviate from the rules established in the white paper from 2008 by Satoshi Nakamoto. This community also considered the PoW method more secure than the alternative. Therefore, the most wasteful network in terms of energy will remain so even in the foreseeable future.