2024-05-25 15:53:10

Following Bitcoin, US ETF itemizing is accredited.

International expectations for acceptance of 加-獨 and many others. one after one other

Monetary authorities: “Approval is tough below present regulation”

Democratic Get together prone to push for incorporation into coin system

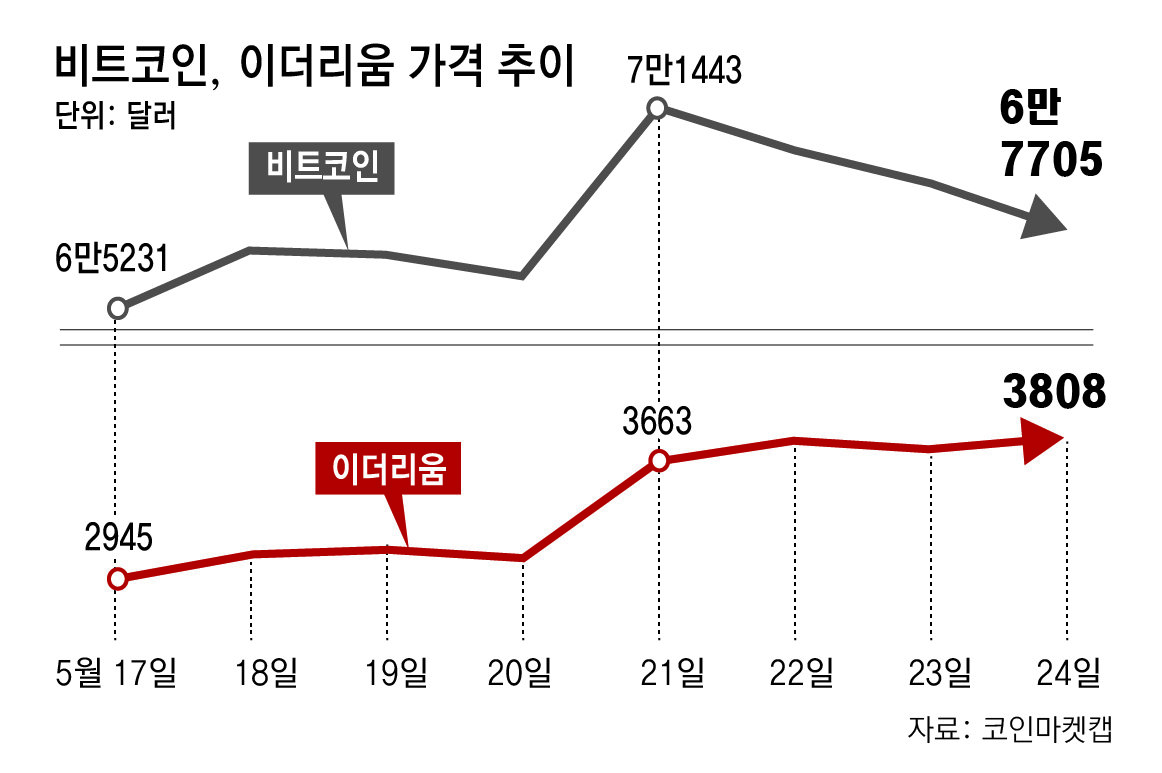

The U.S. Securities and Change Fee (SEC) accredited buying and selling in Ethereum’s spot exchange-traded fund (ETF), following Bitcoin. That is the primary case during which an altcoin (all digital property apart from Bitcoin) has entered the institutional system within the U.S. monetary market, drawing eager curiosity from traders. Accordingly, there are expectations that digital asset funding will turn into extra standard in the US.

Alternatively, Korean monetary authorities nonetheless keep the place that it’s tough to permit spot ETF buying and selling of digital property below present regulation. Nonetheless, because the Democratic Get together of Korea, which received a landslide victory within the normal election, is pushing for the incorporation of main digital property into the system, consideration is being paid as to whether will probably be allowed.

● Following Bitcoin, Ethereum was additionally integrated into the institutional system.

On the twenty third (native time), the SEC accredited a request for itemizing assessment for the Ethereum spot ETF utilized by native asset administration firms reminiscent of Blackrock, Constancy, and Arc21 Shares. It has been about 4 months for the reason that Bitcoin spot ETF was accredited in January of this yr. On at the present time, the SEC stated, “After cautious assessment, the Fee confirmed that this software is per the Securities Change Act and the foundations and laws relevant to the inventory change.” Precise buying and selling is anticipated to be doable within the second half of this yr (July to December) after the SEC approves the securities report. In consequence, the variety of nations which have accredited the itemizing of Bitcoin and Ethereum spot ETFs has elevated to 5, together with the US, Hong Kong, Canada, Germany, and Switzerland.

An ETF is a product that lists index funds on an change and permits them to be traded like shares. Relying on the funding asset, there are inventory and bond ETFs, and many others. Ethereum ETF refers to a product during which an asset administration firm purchases precise Ethereum and manages it as an funding asset. Following Bitcoin, the itemizing of Ethereum’s spot ETF grew to become doable, making it doable for American particular person traders to not directly put money into the digital asset like a normal public providing fund with out going by a coin change. As accessibility to digital property will increase, there’s room for the value of the coin to soar additional sooner or later.

● Korea nonetheless doesn’t permit commerce… investor backlash

Though the US has accredited Ethereum’s spot ETF buying and selling, Korea is prohibited from launching a spot ETF of digital property because of present authorized laws. It’s because below the Capital Markets Act, digital property can’t be used as underlying property for monetary merchandise.

Moreover, it’s unattainable for home traders to put money into U.S. spot ETFs. It’s because the monetary authorities don’t permit securities corporations to behave as brokers for the product. An official within the asset administration trade stated, “We’re informing clients that brokerage of the related inventory is unattainable as a result of monetary authorities’ authoritative interpretation,” and “You possibly can seek for associated shares on the Cell Buying and selling System (MTS), however the purchase and promote buttons don’t work.” “I don’t,” he stated. A high-ranking monetary authority official stated, “The federal government’s stance is unlikely to alter simply because the Ethereum spot ETF, following Bitcoin, has been accredited for itemizing within the U.S.” He added, “If not solely people but in addition monetary establishments improve funding in digital property, market uncertainty could improve. “He stated. That is interpreted as making an allowance for the likelihood that capital market dangers may improve if digital asset ETF buying and selling have been allowed, reminiscent of funds from the inventory market being concentrated into the coin market directly.

Nonetheless, because the Democratic Get together, which holds the vast majority of seats, is pushing for approval of digital asset spot ETFs sooner or later, there’s a risk that an avenue for funding shall be opened sooner or later. As many developed nations, together with the US, are transferring to include digital property into the system, Korea can’t afford to ban them eternally.

Coin traders are additionally protesting towards this place of the monetary authorities, calling it a “coin isolation coverage.” Particularly, blocking the launch of home coin ETFs isn’t sufficient, and blocking funding in abroad merchandise is an extreme funding regulation. Mr. Kim (36), an workplace employee, stated, “Korean shares should not rising nicely, so I’m at all times in search of funding alternatives abroad, reminiscent of within the U.S., however I can’t perceive why they’re blocking the acquisition of digital asset ETFs in any respect.”

Reporter Kang Woo-seok wskang@donga.com

Reporter Shin A-hyung abro@donga.com

-

- nice

- 0canine

-

- I am so unhappy

- 0canine

-

- I am offended

- 0canine

-

- I like to recommend it

- canine

Sizzling information now

2024-05-25 15:53:10