2024-04-25 23:30:44

[상속 ‘유류분’ 제도 위헌]

Civil law includes adultery and dependents provisions

There is room for active litigation by weighing the pros and cons.

Large-scale business litigation, succession structure variables

Following the Constitutional Court’s decision on the 25th, significant changes are expected in the overall inheritance system as the reserve system is put on the operating table. In particular, it is expected to have a lasting impact on the ongoing inheritance-related litigation. There are predictions that there may be a more intense battle over evidence and legal principles in lawsuits requesting the return of oil reserves, as the reasons for the loss of oil reserves and contributions must be disputed in accordance with future amendments to the Civil Act. There are speculations that this could have an impact on management rights disputes in the business world, where inherited assets are large and often involve corporate shares.

● Proof of loss and contribution of oil is expected to become fierce.

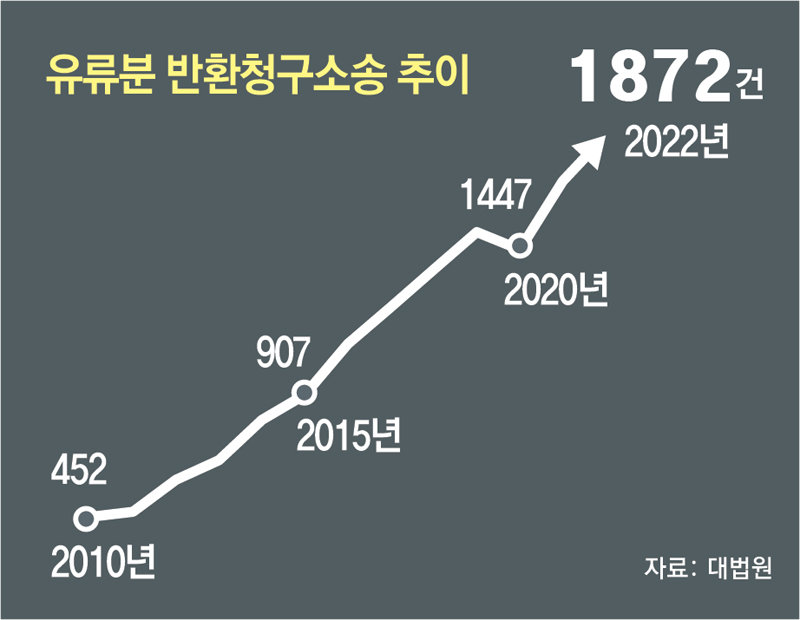

The prevailing view in the business and legal circles is that this Constitutional Court decision will not reduce oil disputes, which are increasing due to the death of the head of a conglomerate. Although the provision for recognition of reserved portion for siblings was immediately invalidated and disappeared, in existing reserved portion lawsuits, there were more disputes over reserved portion between children and spouses than between siblings. In fact, lawsuits requesting the return of fuel are increasing every year from 452 cases in 2010 to 1,872 cases in 2022.

In particular, as the amendment to be prepared by December 31, 2025 due to the Constitutional Court’s decision that it is unconstitutional, will include provisions for ‘reasons for not receiving the reserved portion’ (family members of the corrupt party) and ‘heirs with contributions’ (dependents). There are many predictions that lawsuits claiming the return of fuel will continue from family members of company owners who feel that this is the case. Kim Hyun-jung, a lawyer at Barun Law Firm, said, “Until now, there were no specific regulations on the reasons for loss of reserves or contributions, so there was no room for dispute, but if such regulations become concrete, there will be room for active litigation.” He explained, “The evidence and legal battle to prove whether someone contributed will become fiercer.”

Starting with the deadline for civil law revision, the calculation methods of parties involved in lawsuits over oil reserves are expected to change. If there is a need to claim a cause for loss of contribution or reserve, it is advantageous to file a lawsuit after legislation is enacted. A legal official said, “Any party concerned about the loss of oil reserves is expected to quickly file a lawsuit before the law is revised and implemented.”

● Variables in business management rights, etc.

In the case of large conglomerates or conglomerates, the scale of inherited assets is large and may include corporate shares, so there are observations that changes in the reserve system will have an impact on inheritance of management rights and disputes. Kim Hyun-jin, a lawyer at Sejong Law Firm, said, “In the case of children or spouses who have had a decisive influence on the growth of a company, there is greater room to claim inheritance contributions during the inheritance process.” “It is a factor,” he said.

In the business world, many lawsuits surrounding oil residue are still ongoing. A representative example is the 130 billion won lawsuit surrounding the late BYC founder and former chairman Young-Dae Han. Former Chairman Han’s spouse, Mr. Kim, along with his daughter Han Ji-hyung, a BYC director, filed a lawsuit in December 2022 against BYC Chairman Han Seok-beom and his two sons, including Han Heung Corporation CEO Han Ki-seong, requesting the return of oil. The Seoul Central District Court is currently hearing the lawsuit. Mr. Kim and Director Han claim that they requested a reserve portion from Chairman Han in the process of inheriting the legacy of former Chairman Han, who passed away in January 2022, but did not receive it.

In 2009, the late Heo Young-seop, former chairman of Green Cross, left a will in which he donated some of his assets, including 560,000 shares of Green Cross Holdings, to a social welfare foundation and research institute for North Korean defectors. Accordingly, the eldest son, former Green Cross Vice President Heo Seong-soo, filed a lawsuit against the foundation that inherited the shares, requesting the return of retained shares, and received back over 230,000 shares of Green Cross Holdings stock and 20,000 shares of Green Cross stock. Mr. Lee, the out-of-wedlock child of the late CJ Group honorary chairman Lee Maeng-hee, filed a lawsuit in 2015 against four people, including CJ Group chairman Lee Jae-hyun, for the return of fuel, but lost in 2017.

In the business world, there is a view that former Hyosung Vice President Cho Hyun-moon may file a claim against his older brother, Hyosung Chairman Cho Hyun-jun, and others in the future. There are speculations that he may demand the rights to a reserve share of the shares of Hyosung Group’s listed affiliates worth more than 700 billion won left by the late Hyosung Honorary Chairman Cho Seok-rae, who passed away last month, and insist on equal distribution. The business world is weighing the possibility that Honorary Chairman Cho excluded former Vice President Cho from the inheritance through his will.

Reporter Kim Ja-hyun zion37@donga.com

Reporter Hong Seok-ho will@donga.com

-

- great

- 0dog

-

- I’m so sad

- 0dog

-

- I’m angry

- 0dog

-

- I recommend it

- dog

Hot news now

2024-04-25 23:30:44