Indonesia’s Strategic Shift: Embracing BRICS Amidst Rising Tariffs

Table of Contents

- Indonesia’s Strategic Shift: Embracing BRICS Amidst Rising Tariffs

- The Tariff Landscape: What it Means for Indonesia

- Why BRICS? The Case for a Closer Relationship

- Engaging the Middle East: An Alternative Economic Path

- Domestic Industries: Preparing for Change

- What’s Next for Indonesian Trade Policy?

- Expert Insights: The Bigger Picture

- Conclusion: Navigating Uncertainty for Future Prosperity

- FAQs

- Navigating Trade Turbulence: Is BRICS the Answer for Indonesia? A Q&A with Trade Expert, Dr. Anya Sharma

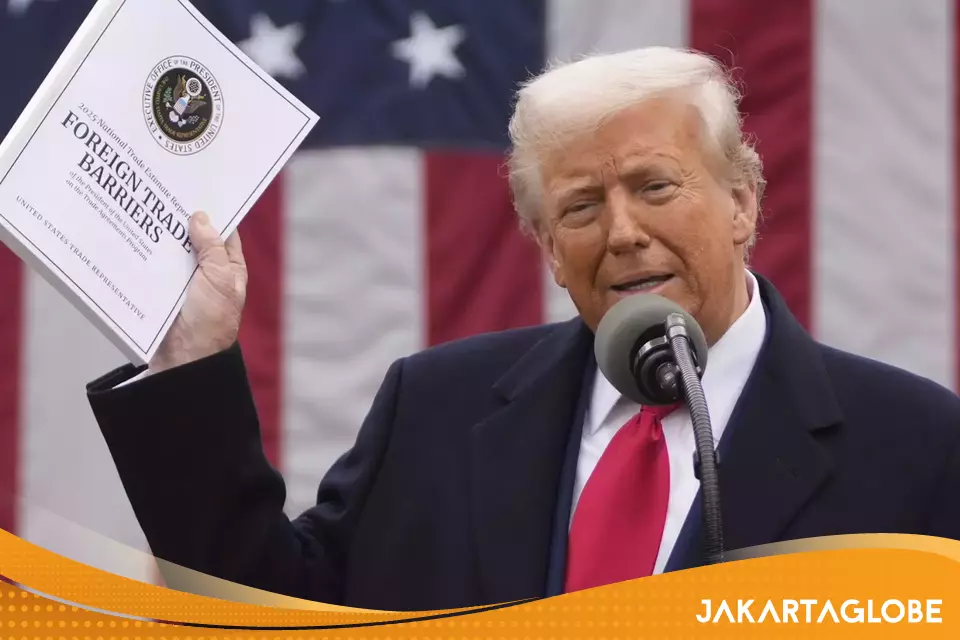

Amid global economic turbulence and escalating trade tensions, Indonesia finds itself at a pivotal crossroads. With rising tariffs from the United States under President Donald Trump, there’s a growing discourse among economists regarding the potential benefits of Indonesia pivoting closer to the China-led BRICS coalition. This shift could redefine trade dynamics in the region and impact economic strategies worldwide.

The Tariff Landscape: What it Means for Indonesia

The newly imposed tariffs, which see Indonesia facing a significant 32% reciprocal rate, come as part of a broader protectionist agenda from the U.S. This is not just a bilateral issue; the potential for a trade war is looming large, prompting Indonesian officials and economists alike to recalibrate their strategies for future trade partnerships.

Unpacking the Tariff Implications

Trump’s latest executive order introduced tariffs that could rise to 49% for various trading partners. To contextualize this for American readers, these measures mean goods imported from Indonesia could become markedly more expensive for American consumers, potentially shifting their purchasing habits.

Why BRICS? The Case for a Closer Relationship

Bhima Yudhistira, a seasoned economist, emphasizes that Indonesia’s future in international trade may depend heavily on strengthening ties with BRICS nations. This bloc, which includes emerging markets such as Brazil, Russia, India, China, and South Africa, presents a strategic counterbalance to escalating tariffs and trade tensions with the U.S.

BRICS: A Growing Economic Powerhouse

As a member of BRICS, Indonesia stands to benefit from increased intra-trade and investment cooperation. Recent developments show that Indonesia’s trade with China – a crucial member of BRICS – soared from $127.8 billion in 2023 to $135 billion within a year. These figures illustrate the potential for dynamic economic partnerships within the bloc, with China as a central player.

Engaging the Middle East: An Alternative Economic Path

Beyond BRICS, there lies the opportunity within the Gulf Cooperation Council (GCC), which encapsulates six Middle Eastern countries. Participating in new trade agreements and collaborations here could serve as a strategic pivot for Indonesia to diversify its economic portfolio, particularly if the criteria for American trade agreements remain steep.

Evaluating the Risks and Rewards

With suggestions that forging stronger ties with BRICS could incite even steeper tariffs from Washington, it’s crucial to assess the broader geopolitical ramifications. Importantly, Bhima underscores that the current tariff levels are already steep enough that further increases may alienate American consumers and markets.

Domestic Industries: Preparing for Change

Indonesian industries, particularly textiles, footwear, electronics, and palm oil, are set to face significant challenges following the implementation of these tariffs. Acknowledging this, economist Eisha Maghfiruha Rachbini calls for a pivot to non-traditional markets and leveraging existing trade agreements to mitigate losses.

Shifting Export Strategies

Indonesia’s exporters must explore alternative destinations for their products. This adaptive strategy involves not just identifying new markets but also reforming production processes to meet international standards and consumer expectations. The challenge now is to act swiftly to safeguard economic interests while navigating this stormy trade landscape.

What’s Next for Indonesian Trade Policy?

At the time of writing, the Indonesian government has maintained a rather muted response to Trump’s tariffs, suggesting a strategy of thorough internal deliberation before public disclosure. Senior minister Airlangga Hartarto has postponed official comments, indicating that a comprehensive approach will be employed to address the rising tariffs comprehensively.

Anticipating U.S. Reactions

Economic analysts are closely watching how the U.S. might react if Indonesia leans into its BRICS partnerships. While Trump has openly expressed disdain for BRICS, heightened tariffs on these additional imports could provoke backlash from U.S. consumers faced with growing costs. There’s a complex balance to be struck, one that Indonesia is poised to navigate adeptly.

Expert Insights: The Bigger Picture

Economic recovery and resilience are at the forefront of discussions among experts. The focus is not only on the immediate impact of tariffs but also on how emerging economies like Indonesia can leverage alliances to foster growth in an increasingly fragmented global trade environment.

Insights from Industry Leaders

In an exclusive commentary, global trade expert Dr. Evelyn Cho notes, “Countries must adapt using a multi-pronged approach, blending diplomacy with robust economic strategies.” Her observations highlight that nations with diversified trade networks will fare better in a volatile market.

In summary, Indonesia’s path forward amid the fog of rising tariffs is not set in stone. By engaging actively with BRICS and exploring alternative markets in the Middle East, Indonesia has the opportunity to safeguard its economic interests and position itself as a formidable player in global trade. It is a testing time for policymakers, industries, and exporters alike, fostering a critical period of innovation and collaboration that may emerge as a turning point in Indonesian trade history.

FAQs

What are the consequences of the new U.S. tariffs on Indonesia?

The new tariffs could significantly affect Indonesian exports, leading to higher costs for consumers and impacting domestic industries such as textiles and electronics.

How will BRICS membership benefit Indonesia economically?

By forging closer ties with BRICS, Indonesia can enhance trade and investment opportunities, diversify its market reach, and potentially buffer against U.S. tariff impacts.

What alternative markets should Indonesian exporters consider?

Indonesian exporters should explore non-traditional markets, particularly in the Middle East and regions aligned with BRICS partners, to mitigate shortages in the American market.

Keywords: Indonesia Trade, BRICS, US Tariffs, Trade War, Economic Recovery, Indonesian Exports, Trade Diversification, Global trade

Time.news: Dr. Sharma,thank you for joining us. The global trade landscape is looking increasingly complex, especially for nations like Indonesia facing rising tariffs from the U.S. Can you break down the immediate impact of these tariffs?

Dr. Anya Sharma: Thank you for having me.The immediate impact is twofold. Firstly, Indonesian exporters across key sectors like textiles, footwear, electronics, and palm oil will face increased costs when selling to the US market. This directly translates to higher prices for American consumers, perhaps impacting demand. The reported 32% reciprocal rate, with the potential to climb to 49%, is a significant barrier.secondly, this protectionist move forces Indonesian businesses to re-evaluate their export strategies and potentially endure losses initially.

Time.news: The article mentions a potential pivot toward BRICS – Brazil, Russia, India, china, and South Africa – as a strategic counterbalance. What are the potential benefits for Indonesia by strengthening ties with the BRICS nations?

Dr. Sharma: BRICS presents a crucial alternative trade pathway. The bloc represents a significant and growing economic powerhouse. Increased intra-trade and investment cooperation within BRICS can provide Indonesia with access to a large,diversified market less reliant on the U.S.For instance,the article highlights the impressive growth in trade between Indonesia and China,a key BRICS member.This demonstrates the potential for dynamic economic partnerships within the bloc to offset losses incurred due to US tariffs. Joining BRICS isn’t just about trade; it’s about enhanced investment opportunities and a more stable economic future for Indonesia.

Time.news: The article also raises the point that greater engagement with BRICS could incite even steeper tariffs from Washington. Is Indonesia walking a tightrope here?

Dr. sharma: Absolutely. There’s a delicate balancing act involved. While closer ties with BRICS offer a buffer, they could potentially escalate trade tensions with the US. Tho, as Bhima yudhistira emphasizes in the article, the existing tariff levels are already substantial. Further increasing them might be counterproductive for the US, as it risks alienating American consumers who would bear the brunt of rising import costs. Indonesia needs to carefully weigh the risks and rewards, demonstrating its ability to navigate this geopolitical landscape adeptly.

Time.news: Beyond BRICS, the Gulf Cooperation Council (GCC) is mentioned as an alternative economic path. How viable is this option for Indonesia?

Dr. Sharma: Diversification is key in navigating trade volatility, and the GCC offers another avenue for Indonesia to accomplish this. By forging trade agreements with these six Middle Eastern countries,Indonesia can further diversify its economic portfolio. This is particularly relevant if the criteria for American trade agreements remain restrictive. It will take careful assessment to determine which industries are best suited for this region,and what adjustments will need to be made.

Time.news: The article underscores the need for Indonesian industries to adapt and reform production processes. What practical advice would you give to Indonesian exporters facing these challenges?

Dr. Sharma: First and foremost, focus on market research. Identify and understand the specific demands and preferences of alternative markets, whether within BRICS, the GCC, or other regions. Adapt product offerings to meet international standards and consumer expectations in those target markets.

Secondly, invest in efficiency and innovation. Streamline production processes to reduce costs and enhance competitiveness. This could involve adopting new technologies, improving supply chain management, or enhancing product design.

Thirdly,leverage existing trade agreements. Explore opportunities within existing trade partnerships to mitigate losses in the US market. A collaborative effort between government and industry is vital here to ensure exporters are aware of all available resources and support.

focus on non-traditional products. Explore growth in products that aren’t subject to high U.S. tariffs. This could include lasting goods, fair trade products, or new emerging sectors.

Time.news: Senior minister Airlangga Hartarto’s postponed public comments suggest a intentional and cautious approach from the Indonesian government.What should readers expect in terms of Indonesian trade policy in the coming months?

Dr. Sharma: I anticipate a carefully calibrated strategy. Indonesia will likely engage in quiet diplomacy with the US while simultaneously strengthening its partnerships with BRICS and exploring other avenues for trade diversification. The government will also likely focus on supporting domestic industries by providing resources, incentives, and guidance to help them adapt to the changing trade surroundings. A comprehensive trade policy will likely emerge, designed to mitigate the impact of tariffs, promote economic recovery, and build a more resilient and diversified trade portfolio for Indonesia.

Time.news: Dr. Sharma, thank you for your insights. They are incredibly valuable as we try to understand these shifting global economics.

Dr. Sharma: My pleasure. It is an honor to assist.