- The price of Ripple rose by about 10% on Friday, reaching levels not seen since May 2021.

- The rally prompted the resignation of SEC Chairman Gary Gensler and the launch of the WisdomTree Physical XRP ETP in Europe on Thursday.

- XRPL DEX activity has reportedly reached record levels, with active launches and open interest also rising.

- The technical outlook suggests a continuation of the rally towards the three-year high of $1.96.

Ripple (XRP) extended its gains by about 10% on Friday, reaching a new annual high of $1.43 and a level not seen since mid-May 2021. The main reasons for the rally were the announcement by Gary Gensler, the Chairman of the The United States Securities and Exchange Commission, the withdrawal and launch of XRP exchange trading product (ETP) in Europe by asset management company WisdomTree.

Another factor favoring the XRP price outlook is the record high decentralized trading (DEX) activity, active addresses, and open interest on the XRP network. Due to the current bullish market sentiment and expectations that XRP’s legal troubles will end soon, bulls are aiming for a target of $1.96, a three-year high.

Why is Ripple rising today?

Ripple price extends its gains by around 10 percent on Friday, reaching levels not seen since mid-May 2021, after already rising more than 30 percent this week. The main reasons for the recent price increase are:

First, SEC Chairman Gary Gensler announced Thursday that he will resign from the agency effective January 20, 2025. The market rose nearly 13 percent Thursday following the news, as investors anticipate an end add to the SEC’s strict “enforcement regulation” that has had a major impact on Ripple and the cryptocurrency sector in general.

Analysts believe that a new, friendlier SEC chairman could lead to a positive outcome in the legal battle between the SEC and Ripple, unleashing XRP’s full potential and wider adoption in the financial ecosystem.

On January 20, 2025, I will retire as Chairman of @SECGov.

One thread ⬇️

— Gary Gensler (@GaryGensler) November 21, 2024

Second, the WisdomTree Physical XRP ETP was launched in Europe on Thursday. The launch allows investors to invest in the native token on the XRP ledger through European regulated markets, a positive sign of the token’s accessibility and liquidity. This renewed interest is likely to attract investors and traders to the XRP token, and corresponding XRP ETF products are expected to be launched in the US.

We are pleased to announce the launch of the WisdomTree Physical XRP ETP, now listed on Xetra, SIX Swiss Exchange and Euronext Paris and Amsterdam.

The WisdomTree Physical XRP ETP offers a simple, secure and affordable way to invest in XRP, one of the most … pic.twitter.com/30VAQVau8t

– WisdomTree in Europe (@WisdomTreeEU) 21. November 2024

Technical Outlook: XRP Could Continue Rally to Three-Year High

Ripple’s weekly chart shows that the price has broken out above $1.27, the 50% price level drawn from the April 2021 high at $1.96 to the June 2022 low at $0.287. On Friday, XRP reached a new annual high of $1.43, hovering around key resistance at $1.40.

A weekend above $1.40 could see XRP extend its rally and retest the next resistance at $1.96, a three-year high.

However, the weekly chart’s Relative Strength Index (RSI) is at 83, indicating highly overbought conditions and increased risk of a correction. Traders should be careful when establishing long positions as a move in the RSI out of overbought territory can be a clear sign of a pullback.

XRP/USDT weekly chart

XRP on-chain metrics are showing bullish signs

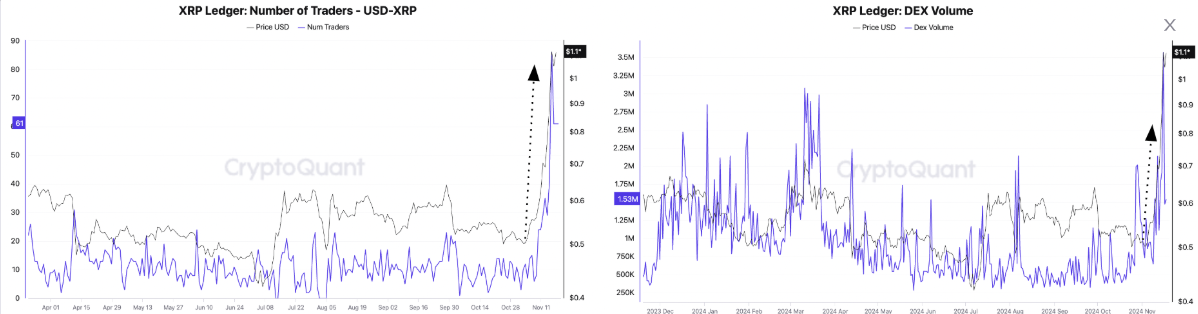

CryptoQuant’s weekly report released on Wednesday continues to support the bullish outlook for Ripple. The report highlights that the price of XRP also coincided with decentralized exchange (DEX) activity on the XRP Ledger (XRPL) network.

DEX volume as of November 15 was $3.5 million, with 80 traders. The new DEX Automated Market Maker (AMM) was launched on XRPL in May of this year to add to the network’s already operational DEX Limit Order Book. Meanwhile, the total number of active addresses on the network has increased significantly, reaching the highest daily value since the beginning of 2024.

XRPL traders and DEX volume graph. Source: CryptoQuant

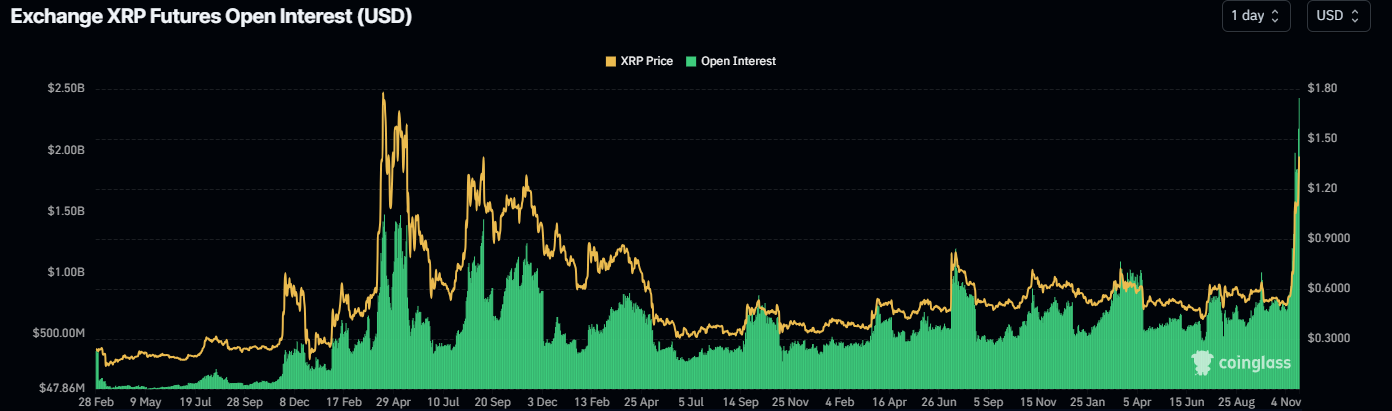

According to data from Coinglass, Ripple futures open interest (OI) on exchanges increased from $1.81 billion on Thursday to $2.43 billion on Friday, a new all-time high. A rising OI means that new or additional money is flowing into the market and new purchases are being made, further supporting the uptrend.

Ripple Open Interest Chart. Quelle: Coinglass

Interview Between Time.news Editor and Cryptocurrency Expert

Time.news Editor: Welcome, and thank you for joining us today to discuss the remarkable surge in Ripple’s price and its implications for the cryptocurrency market. It’s not every day we see such a significant jump, especially when it hits levels we haven’t seen since May 2021. What do you think is driving this current rally in Ripple (XRP)?

Cryptocurrency Expert: Thank you for having me. The recent rally in Ripple’s price can be attributed to several pivotal factors. First and foremost, the announcement of Gary Gensler’s resignation as the SEC Chairman has sent shockwaves through the market. His departure is seen as potentially paving the way for a more favorable regulatory environment for cryptocurrencies, including Ripple.

Time.news Editor: That’s an interesting point. Many investors seem to believe that his resignation could signify an end to the aggressive enforcement actions that have hampered Ripple in the past. How do you think a new SEC leadership could impact Ripple specifically?

Cryptocurrency Expert: A new leadership could lead to a shift towards a more balanced regulatory approach. Analysts predict that this might provide Ripple with the opportunity to resolve its ongoing legal battles with the SEC. If the SEC takes a friendlier stance, it could unlock XRP’s potential and encourage wider adoption. Many believe it could eventually lead to a significant increase in XRP’s price.

Time.news Editor: Absolutely. Another factor that recently came into play is the launch of the WisdomTree Physical XRP ETP in Europe. Could you elaborate on how this development influences Ripple’s market prospects?

Cryptocurrency Expert: Sure! The launch of the WisdomTree Physical XRP ETP allows European investors to access XRP through regulated markets, enhancing the token’s accessibility and liquidity. This move is critical as it not only increases investor interest but also sets the stage for potential XRP ETF products in the U.S. market. Such developments could significantly boost XRP’s visibility and attract more institutional investors.

Time.news Editor: It seems like there’s a whirlwind of positive sentiment surrounding XRP right now. With the technical indicators currently suggesting a potential rally towards the three-year high of $1.96, what do you see as the risks involved as well?

Cryptocurrency Expert: That’s a crucial point to consider. While the bullish momentum is palpable, we need to be cautious. The Relative Strength Index (RSI) shows that XRP is highly overbought at the moment, which suggests a price correction could be imminent. Investors should be wary and closely monitor market conditions. Establishing long positions right now could be risky unless we see a sustenance above $1.40 in the coming days.

Time.news Editor: It appears that a careful approach would be wise. Lastly, let’s touch on the broader picture. How do you evaluate the overall market sentiment towards Ripple and cryptocurrencies following these developments?

Cryptocurrency Expert: The overall market sentiment seems optimistic. The increasing DEX activity and the number of active addresses also indicate heightened interest and engagement on the XRP network. If XRP can sustain its momentum and resolve its legal and regulatory challenges, I believe we could see it playing a crucial role in the evolving financial ecosystem.

Time.news Editor: Thank you for your insights! It’s certainly an exciting time for Ripple and the cryptocurrency market as a whole. We appreciate your perspective on these developments and the potential impact on investors moving forward.

Cryptocurrency Expert: Thank you for having me! Exciting times indeed — I’ll be looking forward to how these events unfold in the coming weeks.