Analyzing the Walmart Earnings Report & Economic Context

Table of Contents

Walmart Inc. is poised to release its earnings tomorrow, a report carrying extra weight due to the shifting U.S.tariff landscape and its economic ripples.Investors are keenly observing the company’s performance, especially after two previous reports showed steady results, setting a potentially positive tone. A clean report could see Walmart stock climb to new highs.

This market focus occurs against the backdrop of ongoing peace talks,which,while yielding no concrete progress thus far,may soon lead to a direct meeting between Ukrainian president Zelenskyy and Russian President Putin.

Weighing Economic Trends Ahead of Walmart earnings

Despite the absence of signals indicating an imminent U.S. economic collapse, current data raises some concerns. A primary focus remains on job growth figures, closely watched by the Federal Reserve.The market reacted unfavorably when job growth fell short of forecasts, with previous months also seeing downward revisions.

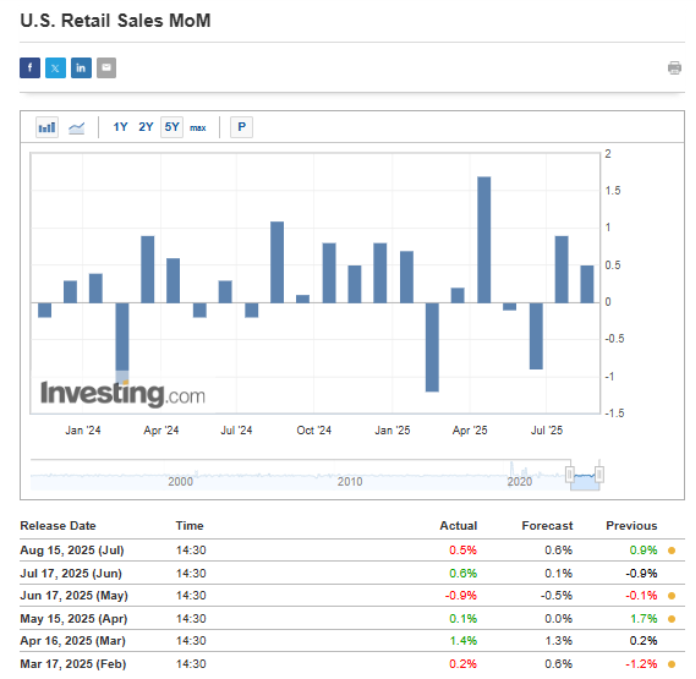

While this presents a caution, it hasn’t yet impacted retail sales, which have shown positive momentum over the last two months.

auto sales, up 1.6%, likely benefited from an impending tax credit expiration at the end of september. The coming months will be crucial for understanding how tariff policies affect prices and retailers’ profit margins.

Analysts will be scrutinizing margins outside of core items,which have seen declines of 34 and 86 basis points year-over-year in the past two quarters. A key area of interest will be Walmart Connect,the company’s advertising platform,which reported a robust 24% year-over-year growth in its last update.

It’s vital to note that roughly one-third of Walmart’s products originate from countries involved in the escalating tariff dispute,especially China,making these external factors significant.

Given recent data revisions trending optimistic, investors are not anticipating a negative surprise.However, the true economic test will unfold with data released over the next three months.

Walmart’s Technical Analysis

Following a sharp decline in early April, Walmart’s stock has been on a steady upward trajectory, nearing its all-time high of approximately $105 per share.

An earlier breakout attempt in March faltered, leading to a retreat to the $100 support level. The prevailing outlook suggests a continued upward trend. The success of this new attempt hinges on several factors: