2024-10-11 21:20:00

Boeing’s new CEO, Kelly Ortberg, has decided to take drastic measures to reduce the company’s costs. This Friday it announced its intention to cut staff by 10%, which means giving up around 17,000 employees through layoffs and uncovered sick leave. The company is going through a long crisis in which security problems have mixed with other cost problems. It has been making a loss since 2019. Furthermore, it has been on strike for a month due to the failure to reach an agreement with the company’s majority union regarding the new collective agreement.

“Our company is in a difficult position and it is difficult to overestimate the challenges we face together,” Ortberg, who took over just two months ago, told employees. “In addition to navigating our current environment, restoring our business requires difficult decisions and we will need to make structural changes to ensure we can remain competitive and service our customers over the long term,” he added.

Ortberg announced this through an internal communication, but simultaneously informed the market of the impact of the strike and other operational problems on its accounts. The company expects third-quarter revenue of $17.8 billion, a loss of $9.97 per share and negative operating cash flow of $1.3 billion. These per-share losses represent red numbers for the company as a whole of approximately $6.1 billion. In the first half of the year, the company suffered losses of about $1.8 billion. The company will publish its accounts on October 23.

“While our company faces near-term challenges, we are making important strategic decisions about our future and have a clear vision of the work we need to do to restore our company,” Ortberg declared this in a statement. “These decisive actions, together with major structural changes to our business, are necessary to remain competitive in the long term. “We are also focusing on areas that are critical to our future and will ensure we have the balance sheet needed to invest, support our people and deliver results for our clients.”

Commercial Aircraft expects to recognize extraordinary pre-tax charges of $3 billion on the 777X and 767 programs. The company now expects first deliveries of the 777-9 in 2026 and the 777-8 freighter in 2028, which implies a charge of $3 billion. 2.6 billion dollars. It also plans to end production of the 767 freighter and recognize a $400 million pre-tax charge on the program. The Commercial Aircraft division expects third-quarter revenue of $7.4 billion and a negative operating margin of 54.0%.

The Defense, Space and Security division, for its part, expects to recognize gross charges of $2 billion in the T-7A, KC-46A, Commercial Crew and MQ-25 programs. This business segment expects third-quarter revenue of $5.5 billion and a negative operating margin of 43.1%.

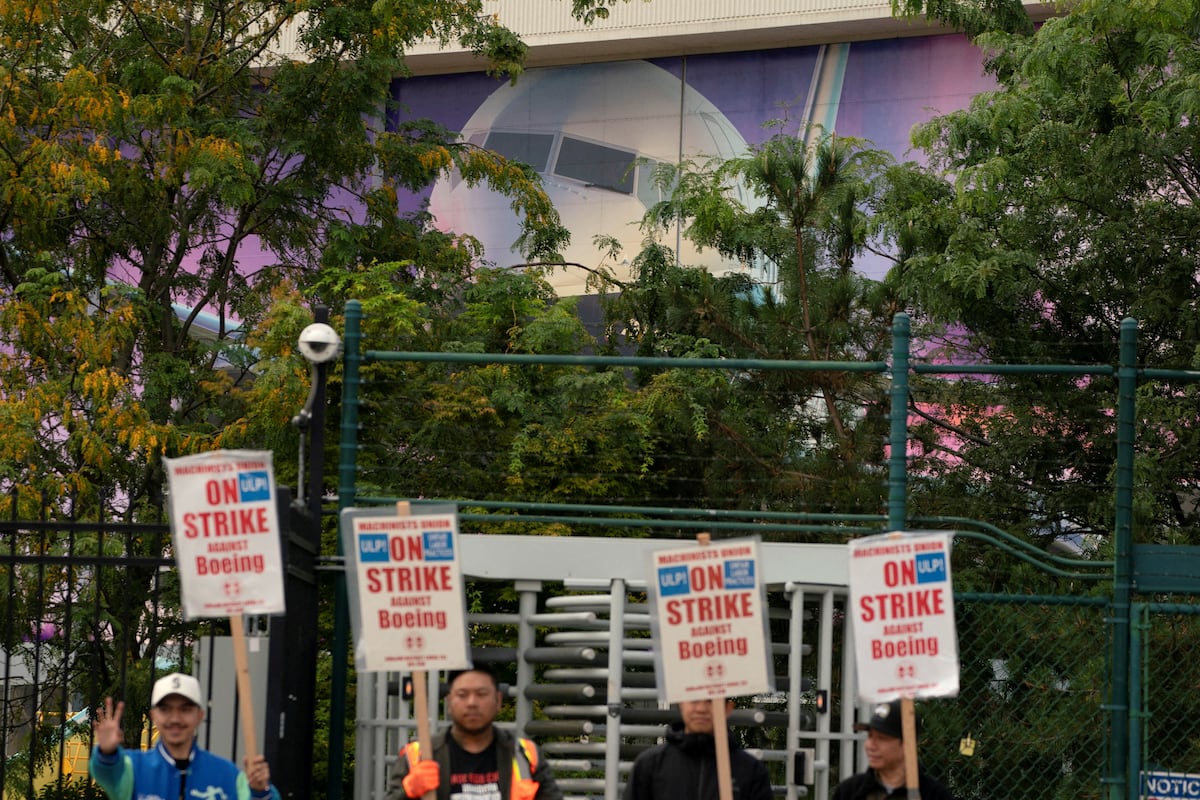

Meanwhile, Boeing is trying to restart negotiations with the unions, but the announcement of the layoffs does not make things easier. The company made two wage increase offers, both of which were rejected by the workers. The latest talks collapsed earlier this week, and it is unclear when and how they might resume. About 33,000 workers at its main plants in the Seattle (Washington) area have been on strike for a month, paralyzing production and generating losses for Boeing.

Before the layoffs, Boeing had already implemented a series of cost-cutting plans. The company has laid off some workers, frozen hiring and cut company travel.

Boeing has been under close scrutiny since an accident earlier this year in which an Alaska Airlines plane lost a panel during flight that covered a hole intended for an emergency door in other configurations of the model, a 737 Max. Also, a harsh report Commissioned by US regulators and published in February it called into question Boeing’s “safety culture” in what is a new blow to the US commercial aircraft maker. The previous president and CEO, Dave Calhoum, announced his resignation in March.

Boeing executives, in a Senate appearance last June attended by relatives of victims of the 737 Max crashes.

Barefoot JIM (EFE)

The Alaska Airlines crash, while not having catastrophic consequences, once again put Boeing and its 737 Max model in the eye of the storm after its flight permit was withdrawn in 2019 – the American manufacturer had even suspended it production – following two fatal accidents that cost the lives of more than 300 people in a variant different from the one that occurred in January. In October 2018, the flight crashed into the Java Sea, Indonesia. 610 of the low-cost airline Lion Air operated by a 737 Max 8; A few months later, in March 2019, 157 people died on Ethiopian Airlines Flight 302 in the largest aviation disaster of that year, which also involved a 737-8.

Boeing agreed in July to plead guilty to conspiracy to commit fraud and pay a $243.6 million fine to resolve a U.S. Justice Department investigation into those two fatal 737 Max crashes.

The company closed last year with losses of 2,222 million dollars (approximately 2,050 million euros). While these are red numbers, their amount is less than half of the previous year’s $4,935 million in losses. The company already suffered losses of $636 million in 2019, which worsened to a record $11,873 million in 2020. Then it lost $4,202 million in 2021. The red numbers accumulated over the past five years amount to approximately $23,800 million and they are on their way to surpassing 30,000 million by adding this year’s.

#Boeing #lay #employees #workforce #reduce #costs #Economy