An apartment in Eunpyeong-gu, Seoul, which was put up for real estate auction, was sold for 670 billion won. It appears that the bidder made a mistake by entering the number incorrectly.

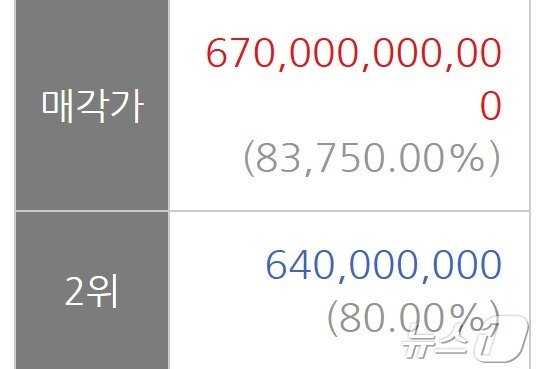

According to News 1 on the 23rd, on the 19th, an 85㎡ property for exclusive use in Eunpyeong New Town, Jingwan-dong, Eunpyeong-gu, Seoul was sold at more than 1,000 times the lowest bid of 640 million won. The ratio of the successful bid price to the appraised price reaches 83,750%.

On the same day, an 85㎡ property with the same conditions was sold for 680 million won.

It is presumed that the bidder accidentally wrote down 670 billion won while trying to write down 670 million won.

This property was auctioned once on the 15th of last month, and was put up for sale again at 640 million won, which is 80% of the appraised price.

The successful bidder is expected to abandon the auction contract. If you abandon the contract or fail to pay the balance, you will not be able to receive a refund of the bid deposit, which is 10% of the minimum bid price. I was in a position to throw 64 million won, the price of a car, into the air.

Cases of losing your deposit due to a mistake in entering numbers often happen. According to GG Auction, among the auction items in the metropolitan area this year, there were a total of eight auctions with a winning bid rate of 500%.

Last June, an apartment in Hwaseong-si, Gyeonggi-do was sold for 3.16999 billion won, 806.6% of the appraised value.

Lee Joo-hyun, a senior researcher at GG Auction, said, “Beginners often write down the price incorrectly, but it is very rare for them to write down 670 billion won on the bidding table. Of course, it is impossible to pay the balance, and the auction will probably be held again later.” explained.

rnrn

Park Tae-geun, Donga.com reporter ptk@donga.com

Hot news now

What lessons can bidders learn from the recent 670 billion won auction blunder in Seoul’s real estate market?

Interview: The Bizarre Auction Blunder – A Conversation with Real Estate Expert Lee Joo-hyun

Editor: Welcome to Time.news, where we delve into exciting stories shaping our world today. Joining me is Lee Joo-hyun, a senior researcher with GG Auction, here to discuss a remarkable incident in Seoul’s real estate market. Thank you for being here, Lee.

Lee Joo-hyun: Thank you for having me! It’s a pleasure to discuss this unusual situation.

Editor: Let’s dive right into it. An apartment in Eunpyeong-gu recently sold for a staggering 670 billion won, seemingly due to a bidding error. Can you explain how this happened?

Lee: Certainly! The property, which had a starting bid of 640 million won, appears to have attracted a miscalculation from the bidder. Instead of entering 670 million won, they accidentally wrote down an astronomically high figure of 670 billion won. The sheer difference is mind-boggling.

Editor: That’s an incredible oversight. How does a bidder end up making such a substantial error, especially in a high-stakes environment like real estate auctions?

Lee: This kind of mistake can happen, especially with newcomers to the bidding process. Typically, inexperienced bidders might get nervous and misplace a comma or a digit, but writing down such a vast amount like 670 billion won is extremely rare. It underscores the need for thorough education and preparation before participating in these auctions.

Editor: Fascinating. With the previous auction for this property being held at 640 million won, what does this incident say about the volatility in the real estate market right now?

Lee: It highlights the extreme volatility and competitive nature of the market. Properties are often being bid up to extraordinary levels compared to their appraised values. In this case, the successful bid price was over 83,000% above the appraisal, reflecting a frenetic environment where emotions can sometimes lead to irrational decisions.

Editor: It sounds like quite a gamble. How does this affect the bidder moving forward, considering the deposit they put down?

Lee: If the bidder decides to abandon the contract, they stand to lose their deposit, which is typically 10% of the minimum bid price. In this scenario, it would be about 64 million won, essentially a hefty sum to lose over a simple miscalculation. This situation serves as a cautionary tale for those entering the auction sphere without proper preparation.

Editor: It must also put pressure on auction houses. How do institutions like GG Auction handle such blunders?

Lee: Auction houses usually have policies in place to mitigate these instances. For example, they often offer pre-auction workshops or educational materials. However, ultimately, bidders are responsible for their bids. The goal is to balance accessibility for new entrants while ensuring that proper protocols are followed to avoid these costly errors.

Editor: You’ve mentioned that this type of misplacement happens occasionally in the market. Can you provide some context on how common these errors are?

Lee: Yes, while it’s rare to see such ludicrous numbers, we’ve noted several instances this year where bids significantly exceeded the appraised values—some even reaching a 500% winning bid rate. It’s particularly prevalent among first-time bidders who may not fully grasp the process or the implications of their bids.

Editor: As this situation unfolds, what do you foresee happening next with the property in question?

Lee: The auction will likely be relaunched, as it’s anticipated that the original bidder will fail to follow through. Such unforeseen circumstances can create additional opportunities for other interested parties in the market, further emphasizing the dynamic nature of real estate.

Editor: Thank you for your insights and analysis, Lee. This incident certainly sheds light on the complexities of the real estate market and the importance of diligence in bidding. We appreciate your expertise.

Lee: Thank you for the opportunity to share my thoughts! It’s always interesting to discuss the real estate landscape, especially with such surprising developments.

Editor: And for our viewers, remember to stay informed and heed the advice of experts when navigating the real estate auction process. Until next time, we will keep you updated on the latest developments at Time.news.