Concerns about the double whammy of exports to the US and China due to Trump’s protectionism

“The semiconductor chip and science law (Chips Act) is a really bad deal. We didn’t have to spend even 10 cents. “By imposing high tariffs on semiconductors imported by the United States, we will force them (Korean and Taiwanese semiconductor companies) to enter the United States and build factories without any compensation.”

This is what U.S. Republican presidential candidate Donald Trump said on a recent podcast. Trump, who had announced that he would pursue a policy of large-scale tariff increases if he wins the November presidential election, reaffirmed his plans for semiconductor-related tariffs. If the Trump-style protectionism, which aims at ‘universal tariffs of 20% and tariffs of 60% on Chinese products’, becomes a reality, Korea, which accounts for a large portion of exports, is expected to be one of the countries that will suffer a significant blow. This is because not only can we face a bombardment of tariffs on exports to the United States, but we can also see reflex disadvantages due to the Chinese economic downturn.

Semiconductor Chip Act and Automobile IRA ‘at stake’

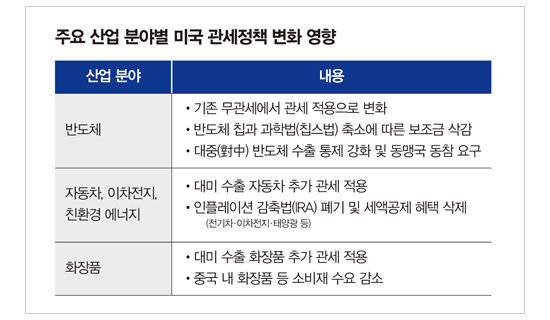

A representative industrial sector affected by Trump’s high tariff policy is semiconductors (see table). In the meantime, Trump has expressed his intention to apply tariffs on semiconductors, saying, “Taiwan has stolen the U.S. semiconductor industry.” Previously, semiconductors were exported and imported tariff-free according to the World Trade Organization (WTO) Information Technology Agreement (ITA), but the possibility of breaking this has increased. Additionally, Trump is suggesting a reduction or abolition of the Chips Act, which was promoted under the Joe Biden administration. Previously, Samsung Electronics and SK Hynix established a Taylor foundry plant in Texas and a packaging plant in Indiana, respectively, and received subsidies of $6.4 billion (approximately 8.8 trillion won) and $450 million (approximately 621 billion won) in subsidies under the Chips Act. I decided to receive it, but the contents may change. In addition, if we strengthen controls on semiconductor exports to China and ask our ally South Korea to participate, exports to China will also be blocked.

Dark clouds are also hanging over the automobile, secondary battery, and eco-friendly energy industries. The United States accounts for an overwhelming share (45.4% as of last year) in Korea’s ranking of automobile export countries. In this situation, if Trump imposes additional tariffs, the competitiveness of Korean automobile companies such as Hyundai Motors will inevitably suffer a major blow. During his previous term, Trump had considered applying a 25% tariff on automobiles by invoking Article 232 of the Trade Expansion Act. The fact that they are professing to abolish the Inflation Reduction Act (IRA) is also a significant threat to Korea. In response to the disappearance of tax credit benefits for industries such as electric vehicles, secondary batteries, and solar energy, many Korean companies are entering the U.S. (Hyundai Motors and Kia for electric vehicles, LG Energy Solution, SK On and Samsung SDI for secondary batteries, Hanwha Q CELLS for solar power, etc.) ) can suffer damage. However, Georgia, where Korean companies’ factories are concentrated, is a Republican-dominant state, and analysts say it will be difficult to fully recover the IRA budget that has already been finalized by Congress.

Dark clouds are also hanging over the automobile, secondary battery, and eco-friendly energy industries. The United States accounts for an overwhelming share (45.4% as of last year) in Korea’s ranking of automobile export countries. In this situation, if Trump imposes additional tariffs, the competitiveness of Korean automobile companies such as Hyundai Motors will inevitably suffer a major blow. During his previous term, Trump had considered applying a 25% tariff on automobiles by invoking Article 232 of the Trade Expansion Act. The fact that they are professing to abolish the Inflation Reduction Act (IRA) is also a significant threat to Korea. In response to the disappearance of tax credit benefits for industries such as electric vehicles, secondary batteries, and solar energy, many Korean companies are entering the U.S. (Hyundai Motors and Kia for electric vehicles, LG Energy Solution, SK On and Samsung SDI for secondary batteries, Hanwha Q CELLS for solar power, etc.) ) can suffer damage. However, Georgia, where Korean companies’ factories are concentrated, is a Republican-dominant state, and analysts say it will be difficult to fully recover the IRA budget that has already been finalized by Congress.The cosmetics industry, which is pioneering the U.S. market in earnest, is also likely to take a hit. Recently, cosmetics have been showing remarkable growth in the United States instead of China, which was the previous largest market. In particular, the popularity of small and medium-sized cosmetics brands is increasing day by day thanks to the ‘K-Beauty’ craze. An official in the domestic cosmetics industry said, “We have set the change in U.S. tariff policy as one of the risks and are closely watching it. We are not yet at the stage of taking direct action, but if additional tariffs become a reality, we are considering manpower and marketing cost efficiency, etc.” . Additionally, if the U.S. trade pressure on China intensifies, Chinese domestic demand will slump and demand for consumer goods such as cosmetics will decrease. The cosmetics industry, which is centered around China along with the United States, is suffering a double blow. This is also the background to the decline in cosmetics stock prices when the ‘Trump Trade’ appeared in the stock market immediately after the Trump attack in July.

“China’s 60% tariff will also be a blow to Korea.”

Domestic experts are concerned that “Trump’s tariff increase policy could shake up the Korean economy, which is mainly exported to the US and China.” An official from the Korea Institute for Industrial Economics and Trade (KIET) said, “Not only are exports to the U.S. threatened by (Trump’s) universal tariffs, but the U.S.’s bashing of China will also come back as an arrow to Korea,” adding, “If China’s domestic demand stagnates, raw materials that make China a major export destination “Many industries, including parts, may experience a recession,” he said. This official continued, “In the semiconductor sector, some positive effects may occur, such as Samsung Electronics and SK Hynix overtaking Chinese semiconductor companies that have recently been chasing them closely.” He also added, “If the export route to China, which accounts for about a quarter of Korea’s trade, is blocked, that “It is a situation that is not beneficial to Korea as the results are offset,” he added.

《This article Weekly Donga It was published in issue 1463》

- I’m angry

- 0dog

Hot news now

It appears that you provided an article excerpt discussing potential economic impacts if Donald Trump wins the upcoming presidential election and implements high tariff policies. The article highlights concerns regarding various sectors, particularly semiconductors, automobiles, and cosmetics, which may be adversely affected by Trump’s proposed universal tariffs and specific tariffs on Chinese products.

According to the article:

- Semiconductors: Trump’s plan may involve applying tariffs on semiconductors and rolling back initiatives like the Chips Act, which provided significant subsidies to firms like Samsung and SK Hynix. This could disrupt the industry since exports were previously tariff-free under WTO agreements.

- Automobiles: The U.S. is a major market for South Korean car manufacturers. The article suggests that Trump’s introduction of additional tariffs could severely impact companies like Hyundai Motors. His previous consideration of a 25% tariff on automobiles stands as a notable threat.

- Cosmetics: The rising popularity of K-Beauty in the U.S. market might face challenges due to changing tariff policies. There are concerns about the dual impact from potential tariffs and decreased demand from China, where many cosmetics also find a market.

- Trade Relations and Economic Concerns: Analysts express worry that Trump’s tariff increases could destabilize the Korean economy, which heavily relies on exports to the U.S. and China. There’s apprehension that if Chinese demand falters due to U.S. pressures, it could create a ripple effect affecting various sectors in Korea.

the article underlines the interconnectedness of global trade and how shifts in U.S. trade policy can have far-reaching impacts on allied nations’ economies, particularly those of South Korea.