Teh businessman Ricardo Salinas Pliego is no longer inside the list of the 500 richest people in the world after the collapse of the shares of Elektra.

Yesterday, December 2, the value of each Grupo Elektra share closed at 285 pesosequivalent to a drop of 70% after the resumption of its listing on the Mexican Stock Exchange (BMV) after its suspension last July.

The fall in Elektra shares represents a loss of 5 thousand 500 million dollars (almost 112 billion pesos) for Ricardo Salinas Pliego, who is the main shareholder of Grupo Salinas.

Elektra/Banco Azteca (Cuartoscuro / Edgar Negrete lira)

Ricardo Salinas Pliego is left out of the list of the 500 richest people in the world

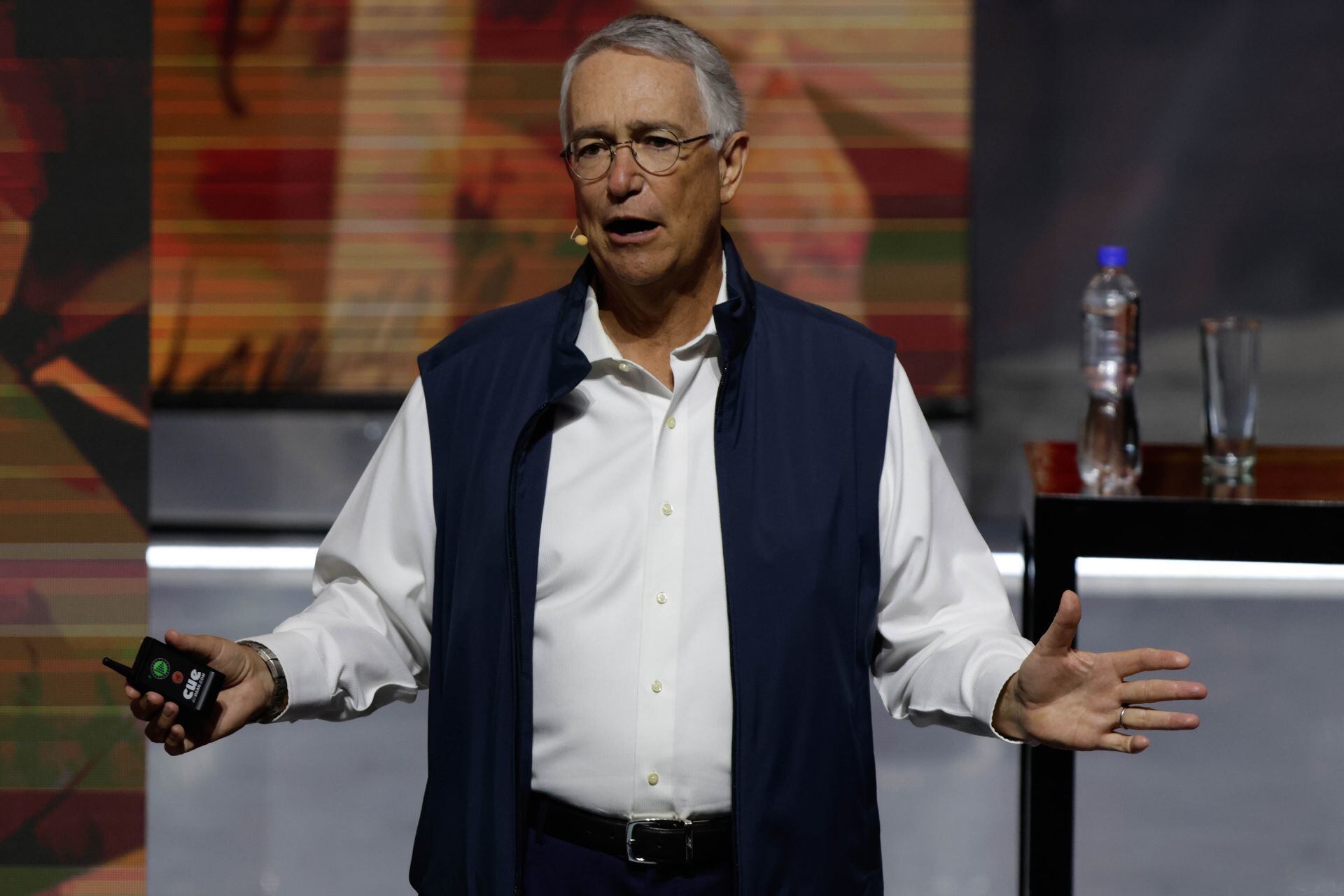

Ricardo Salinas Pliego leaves the list of the 500 richest people in the world (Mireya Novo/Cuartoscuro)

Ricardo Salinas Pliego was left out of the list of the 500 richest people in the world, according to the Bloomberg Billionaires Index.

However, with the fall in Elektra shares this Monday, the president of Grupo Salinas is no longer on the list of the 500 wealthiest people on the planet.

For their part,the Mexicans also Carlos Slim,Germán Larrea and Alejandro Baillères Guam Thay remain in positions 18,49 and 497 respectively.

The list is headed by Elon Muskfollowed by Jeff Bezos and Mark Zuckerberg.

Why did Ricardo Salinas pliego leave the list of the 500 richest people in the world?

With the resumption of the purchase and sale of Elektra shares on the Mexican Stock Exchange, Shareholders auctioned off their sharesthus causing a collapse for the company and, consequently, for the fortune of Ricardo Salinas Pliego.

Grupo Elektra, in a desperate attempt to stop the fall before the closing of the BMV, warned investors that “any transaction with the shares could imply liability for the parties involved in them.”

He also criticized the order of the National Banking and Securities Commission (CNBV) to the BMV to resume the purchase and sale of shares of the financial branch of Grupo Salinas and noted that the measure “has generated abnormal movements in terms of price and volume operated, causing irreparable damage”.

furthermore, the spokesperson for Grupo Salinas, Luciano Pascoe, threatened: “It is our obligation to reiterate that the resumption of the negotiation of these shares, in addition to causing irreparable damage, could involve improperly obtained shares”.

How can investors protect themselves from volatility in teh stock market triggered by events like the fall of a major business figure?

Interview Between Time.news Editor and Financial Expert

Time.news Editor: Welcome to our special segment today. We have with us Dr. Maria Lopez, a financial analyst and expert in the stock market.Today, we are discussing the recent dramatic fall in the value of Grupo Elektra shares, which has led to Ricardo Salinas Pliego no longer being part of the world’s 500 richest individuals. Welcome, Dr. Lopez.

Dr. Maria Lopez: Thank you for having me. It’s great to be here to discuss such an crucial topic.

Time.news Editor: Let’s dive right in.The share price of Grupo Elektra has seen a staggering drop of 70%, closing at 285 pesos. What are the primary factors that contributed to this sudden decline?

Dr. Maria Lopez: There are several factors at play here. The suspension of Elektra’s stock for several months led to uncertainty among investors.Additionally, market conditions, company-specific issues, and economic factors in Mexico can heavily impact stock performance. When shares were finally relisted, that accumulation of uncertainty likely triggered panic selling.

Time.news Editor: That makes sense. I read that this collapse represents a massive loss—over 5.5 billion dollars for Salinas Pliego. How does such a meaningful drop in a single company’s stock affect the overall market and investor sentiment?

Dr. Maria Lopez: A drop of that magnitude can have a ripple effect in the market. Investors typically look for stability and confidence; when a prominent figure like Salinas Pliego suffers such a loss, it can create broader concerns about the stability of the market as a whole, especially in sectors connected to Elektra. Investor sentiment can become negatively skewed, impacting not just Elektra but related businesses and industries.

Time.news Editor: Interestingly, Ricardo Salinas Pliego has been a prominent figure in Mexican business. What does his fall from the list of the world’s richest signify for the business landscape in Mexico?

Dr. Maria Lopez: His fall is quite significant, considering he was not only a business icon but also an influencer in various sectors. It highlights the volatility and unpredictability of wealth, especially in emerging markets. This might serve as a wake-up call for both investors and entrepreneurs in Mexico, emphasizing the necessity of maintaining robust and diversified business strategies to mitigate risks.

Time.news Editor: Many viewers might be curious—what should investors keep in mind when they see such volatility?

Dr. maria lopez: Absolutely. Investors should always be cautious and do their due diligence before investing. Diversifying their portfolio can definitely help minimize risks. it’s also essential to keep an eye on the economic indicators and company fundamentals rather than succumbing to emotional reactions during market fluctuations.

Time.news Editor: That’s sage advice, Dr. Lopez. As we see this situation unfold, how do you foresee the recovery for Grupo Elektra and Salinas Pliego?

Dr. Maria Lopez: Recovery could take time. Elektra will need to address the underlying issues that led to this drop, focus on rebuilding trust with investors, and possibly adapt their business model to changing market conditions. Simultaneously occurring, Salinas Pliego’s resilience as a businessman could led him to some innovative strategies to rebound, but it’s a long road ahead.

Time.news Editor: Thank you, Dr. Lopez, for your insights into this critical situation. it’s undoubtedly a time of uncertainty, but as you’ve pointed out, there are lessons to be learned here for both investors and entrepreneurs.

Dr. Maria Lopez: Thank you for having me. It’s been a pleasure to discuss these important issues.

Time.news Editor: And thank you to our audience for tuning in. Stay informed and stay safe in your investments.