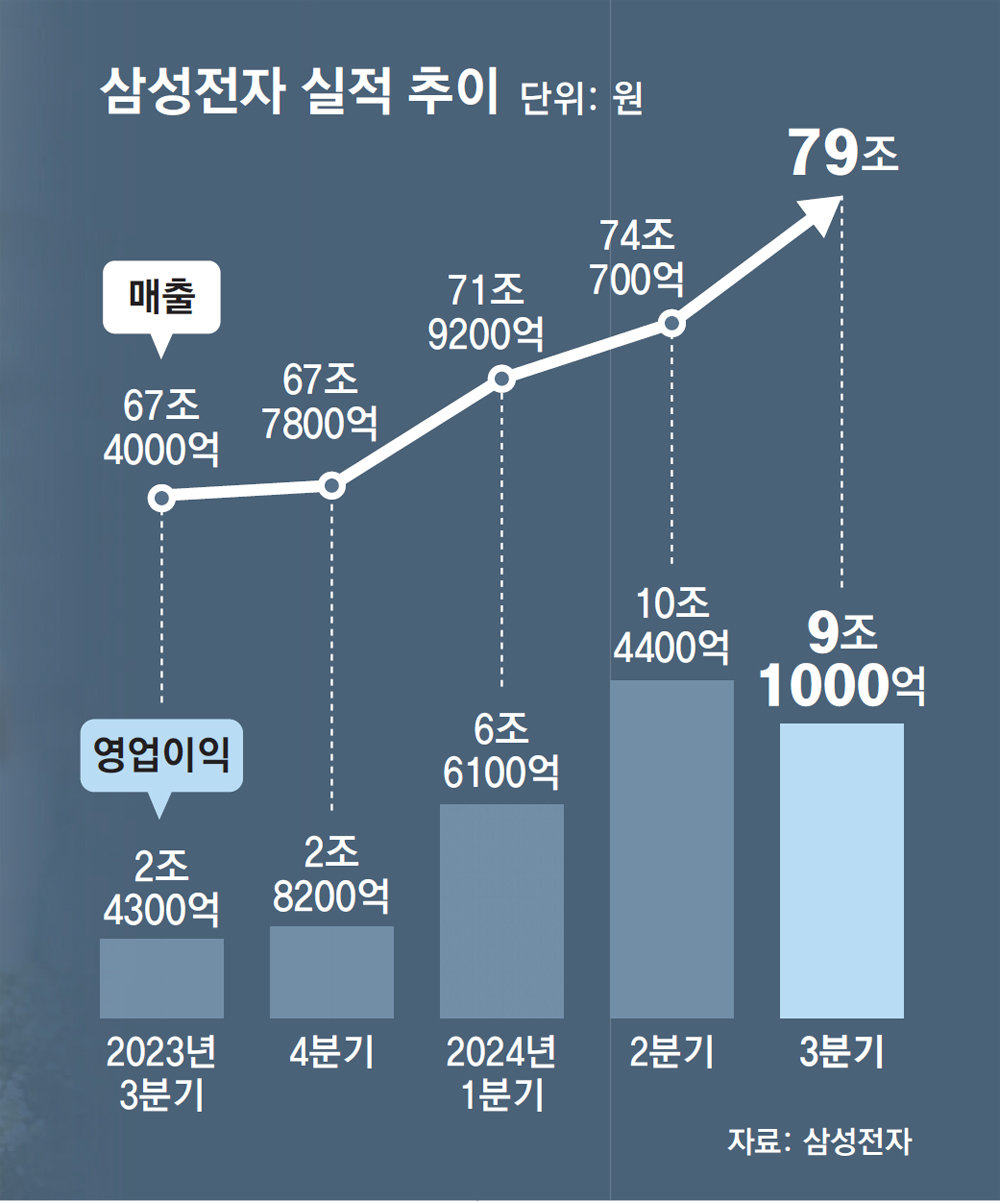

Operating profit decreased by 12.8% from the second quarter to KRW 9.1 trillion

Division Manager Jeon Young-hyeon “It’s an opportunity for a leap forward”

Quarterly sales reached record high of KRW 79 trillion

Samsung Electronics announced earnings that fell below market expectations with an operating profit of 9 trillion won in the third quarter (July to September). Semiconductor management apologized for the first time for its performance failing to exceed the ’10 trillion’ barrier and promised to tackle the ‘Samsung crisis theory’ head on.

On the 8th, Samsung Electronics announced preliminary results of 79 trillion won in sales and 9.1 trillion won in operating profit for the third quarter on a consolidated basis. Sales rose 6.7% from the previous quarter, recording the highest ever quarterly sales, but operating profit fell 12.8% compared to the previous quarter. In particular, operating profit was significantly below the 10.7717 trillion won predicted by securities analysts. The trend of improving operating profit, which had continued for six consecutive quarters since the first quarter of last year (January to March), also slowed down.

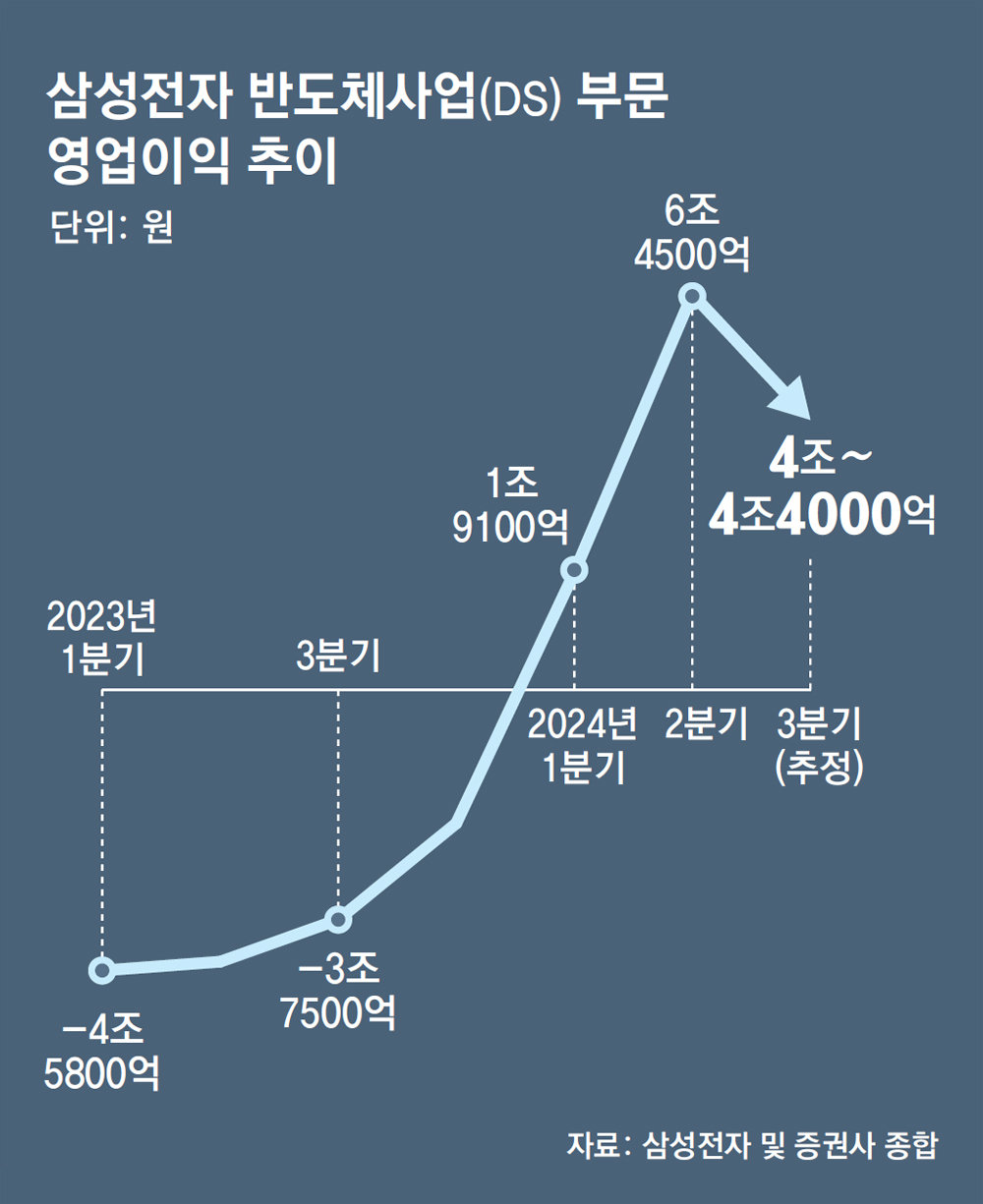

Although Samsung Electronics did not disclose performance by business division in the provisional results announced on this day, the market believes that this is due to a decrease in operating profit of the semiconductor business by approximately 1 trillion won compared to the previous quarter. The analysis is that Nvidia’s supply of high-bandwidth memory (HBM), which benefits from artificial intelligence (AI), has been delayed, and general-purpose DRAM has been pushed out by China’s low-price offensive.

As concerns grew about Samsung Electronics’ competitiveness beyond poor quarterly performance, Jeon Young-hyun, head of the semiconductor division and vice-chairman of the DS division, issued an unusual apology, saying, “I apologize for causing concern with performance that did not meet market expectations.” He continued, “To overcome the crisis, the management will take the lead and create an opportunity for a leap forward.” This is the first time that Samsung Electronics’ top management has issued a separate statement regarding its performance. Meanwhile, Samsung Electronics’ stock price closed at 60,300 won on this day, down 1.15% from the previous day.

Samsung Electronics, general-purpose DRAM slump – crisis due to HBM delay… Announcement of major renovation

Unusual apology for ‘poor third quarter performance’

Demand for PC-smartphone memory is decreasing… Foundry deficit – fixed cost burden increases

Vice Chairman Jeon Young-hyun “Restoring fundamental competitiveness… “Rearmament of challenging spirit – improvement of organizational culture”

Despite record-high quarterly sales, Samsung Electronics’ provisional operating profit for the third quarter (July to September) fell short of market expectations, largely because its semiconductor business was sluggish than expected. Although demand for general-purpose DRAM is sluggish, the foundry deficit has widened, and performance bonus provisions worth 1 trillion won have been reflected in this.

In particular, it has been reported that the highly anticipated 5th generation high bandwidth memory (HBM) ‘HBM3E’ has not yet passed the NVIDIA quality test, increasing concerns about Samsung’s competitiveness itself. This is why Jeon Young-hyun, head of the semiconductor business (DS) division (Vice Chairman), unusually apologized to employees and investors and promised reform.

● Semiconductor boom stalled at HBM’s ankles

Among the 9.1 trillion won in operating profit for the third quarter announced by Samsung Electronics on the 8th, major securities companies believe that the DS division would have made an operating profit of 4.4 trillion won to 4.4 trillion won. This is significantly below the previous forecast, which was in the mid-5 trillion won range.

First of all, performance of the flagship memory was below expectations. General-purpose DRAM for smartphones and PCs is sluggish, and China’s Changshin Memory Technology (CXMT) is pushing out low-priced volumes, which has been a burden. Due to sluggish orders, the operating rate of the foundry business fell, the burden of fixed costs increased, and the size of the deficit also increased. One-time costs for excess profit performance (OPI), which are scheduled to be paid early next year, also occurred over 1 trillion won. OPI is a performance bonus that is paid up to 50% of an individual’s annual salary, with a limit of 20% of excess profits when the goal set at the beginning of the year is achieved.

The problem is the supply of HBM, which is the origin of the Samsung Electronics crisis theory. Samsung Electronics stated in its explanatory material that day, “In the case of HBM3E, commercialization for major customers has been delayed compared to expected.” It was planned to supply 5th generation HBM (HBM3E) 8-layer products to NVIDIA in the third quarter and 12-layer products in the second half of the year (July to December), but this means that they are being delayed more than expected. The analysis is that this is because it has not yet passed the Nvidia quality test. On the other hand, even America’s Micron, which ranks third in permanent memory, has recently performed better than expected in the market thanks to demand for HBM.

Noh Geun-chang, head of the research center at Hyundai Motor Securities, said, “There is room for improvement in memory in the fourth quarter, but foundry is unlikely to improve from this quarter.” He added, “It is expected that more than a year will be needed for the current situation to improve.”

● Will “rearmament with a spirit of challenge” accelerate the pace of reform?

Samsung chose to tackle the crisis theories raised both internally and externally. On this day, the former vice president and head of semiconductors issued an unusual statement and promised reform. Former Vice Chairman admitted, “The performance that fell short of market expectations has caused concerns about fundamental technological competitiveness and the future of the company,” and added, “All responsibility (for Samsung Electronics’ crisis theory) lies with the management leading the business.” In order to overcome the current situation, they proposed ‘restoration of fundamental technological competitiveness’, ‘more thorough preparation for the future’, and ‘improvement of organizational culture and working methods’ as solutions.

This is the first time that Samsung Electronics management has issued a separate message related to its performance announcement. There is an analysis that he took action to early dispel the theory that Samsung is in crisis, which has been raised due to the recent decline in the stock price and concerns about technological competitiveness.

Vice Chairman Jeon said, “Once we set a goal, we will stick to it until the end and rekindle our unique passion to achieve it.” He added, “Rather than a mercurial mindset that seeks to protect what we have, we will re-arm ourselves with a challenging spirit that runs toward a higher goal.” He promised. The intention is to overcome the crisis by reviving Samsung Electronics’ ‘super gap’ heritage.

He then predicted a large-scale personnel reform, saying, “We will rebuild our traditional organizational culture of trust and communication.” Currently, the DS division is pursuing tangible and intangible innovations, such as reorganizing the organization by bringing together the HBM development team that was scattered across various departments, and establishing a new ‘Semiconductor Chain Creed’ for the first time in 40 years.

Meanwhile, thanks to strong sales of flagship smartphones such as the Galaxy S24, the Device Experience (DX) division is estimated to have posted an operating profit of around 3 trillion won. Samsung Display is expected to have an operating profit of 1.4 trillion won, and Harman is expected to have an operating profit of 300 billion won.