Financial authorities take control of household debt management

Unification of jeonse loan guarantee rate to 90%… In the metropolitan area, it may drop to 80%.

Stage 3 stress DSR implemented from July… Annual income: 100 million won, loan limit: 24 million won ↓

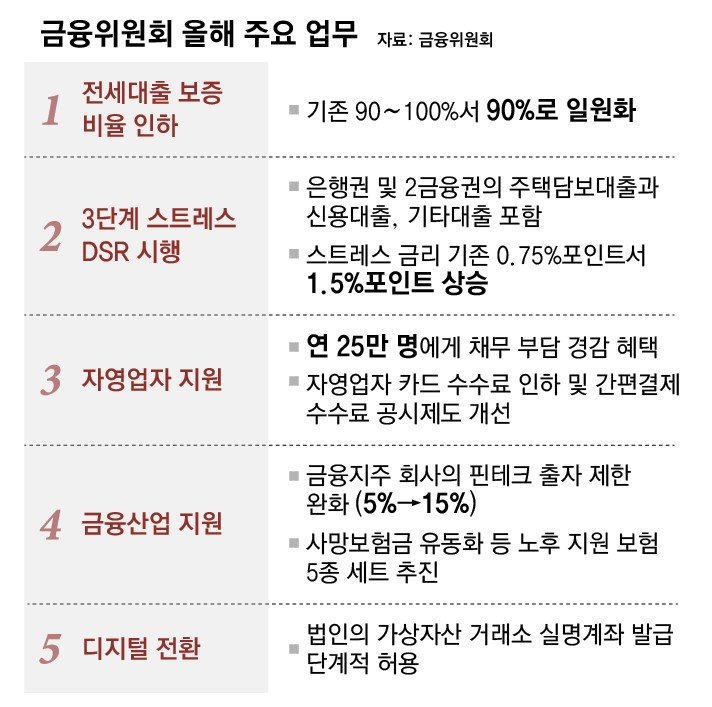

It is expected that the screening of jeonse loans will become more stringent this year, and the amount that can be loaned will decrease. This is because the financial authorities decided not to let go of the reins in household debt management, such as lowering the jeonse loan guarantee ratio from 90-100% to 90% this year. The implementation of the 3rd stage stress Debt Service Ratio (DSR) in July this year will also be promoted as scheduled.

● Unification of jeonse loan guarantee ratio to 90%… DSR stage 3 is also promoted

The Financial Services Commission announced on the 8th that it will continue to manage household debt through a business report after the ‘2025 Meeting on Solutions to Major Issues in the First Economic Sector’. Currently, the rental loan guarantee rate is 100% from the Housing and Urban Guarantee Corporation (HUG) and SGI Seoul Guarantee, and 90% from the Korea Housing Finance Corporation (HF), but the plan is to unify this to 90%. This is due to the awareness of the problem that excessive supply of jeonse loans has occurred due to the structure in which full guarantee is provided.

The Financial Services Commission expects that if the guarantee ratio goes down, banks will have the effect of suppressing the increase in household debt by making their responsibilities more stringent in their review of jeonse loans. We are also considering lowering the guarantee rate only in the metropolitan area. The financial world believes that it could be lowered to 80%. However, it was decided not to immediately pursue a plan to include jeonse loans within the DSR regulations. Kwon Dae-young, Secretary-General of the Financial Services Commission, said, “Rather than including DSR in jeonse loans, we have decided to (manage jeonse loans) toward unifying the guarantee ratio.”

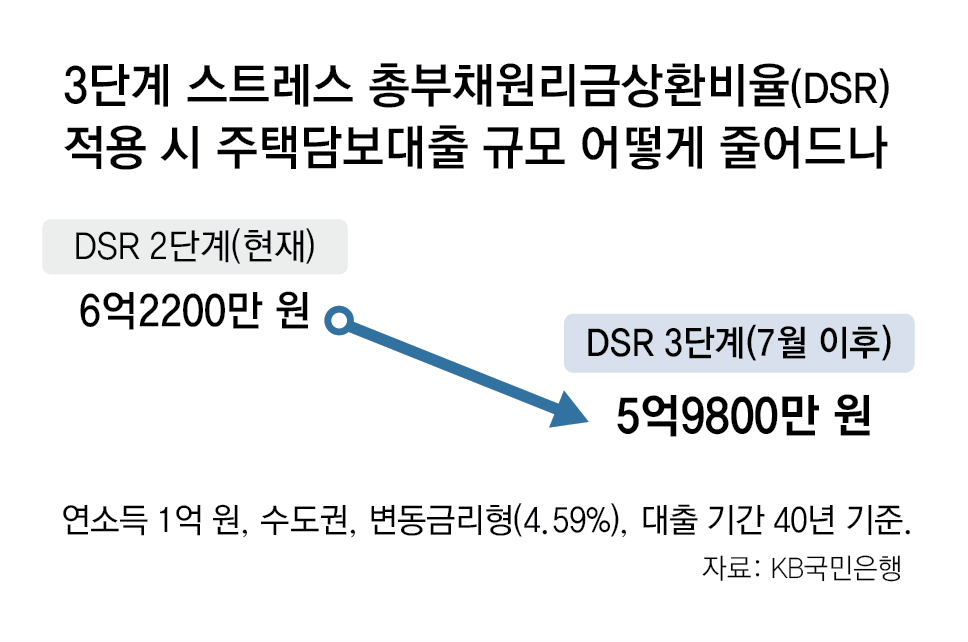

In addition, the 3rd stage stress DSR will be promoted as planned. Stress DSR is a system that calculates the loan limit by adding a certain level of additional interest rate (stress interest rate) when calculating DSR, taking into account the possibility that the burden of principal and interest repayment will increase due to rising interest rates during the loan use period. As the stress interest rate rises, the loan limit shrinks.

With the implementation of the first stage stress DSR regulation in February last year, the stress interest rate was added by 0.38% to bank housing mortgage loans, and from September of last year, 0.75% point was added to bank mortgages and credit loans and secondary financial sector mortgages, and to bank mortgages in the metropolitan area. An additional interest rate of 1.2% points began to be applied to fences. Now, starting from stage 3, the stress interest rate will be increased to 1.5% points, and it will also apply to second-tier financial institutions’ credit and other loans.

When the third phase is implemented, the loan amount for an office worker with an annual income of 100 million won in the metropolitan area is expected to drop from 622 million won to 598 million won based on a 40-year loan period and variable interest rate (4.59%). An official from a commercial bank said, “The financial authorities’ regulations on household loans are expected to increase the lending threshold in the future, with each bank changing its decision-making on new loans from branch screening to headquarters screening.”

● Gradual permission for corporate virtual asset investment

This year’s work report also included measures to encourage financial innovation. Financial holding company fintech investment restrictions (5% → 15%) will be relaxed. In order to strengthen cooperation between financial holding companies and fintechs, it was decided to allow stock ownership of up to 15% in fintech companies and allow fintech companies that are subsidiaries of financial holding companies to control financial companies.

Starting this year, investments in virtual assets by corporations will also be allowed in stages. The Financial Services Commission explained that it will review a plan to gradually allow corporations to issue real-name accounts on exchanges through discussions with the Virtual Asset Committee.

The Financial Services Commission also plans to make every effort to provide support to self-employed people and small and medium-sized businesses that have been hit hard by the economic cold wave. To this end, it was decided to expand the supply of policy finance to the highest level ever (a total of 247.5 trillion won) and quickly execute more than 60% of it in the first half of the year. We will also quickly implement a plan to relieve the financial burden of 600 to 700 billion won per year on self-employed people before they delinquent through prior debt adjustment.

To help people prepare for their retirement, the so-called ‘five types of retirement support insurance sets’ will also be introduced. We plan to allow death benefits to be converted into goods in kind, such as pensions, and to allow medical expenses to be spent through cards linked to Individual Asset Management Accounts (ISA) and pension accounts.

Reporter Lee Ho number2@donga.com