US President-elect Donald Trump has set off the ‘tariff time bomb’ timer. They have already issued a tariff notice of 25% to Canada and Mexico and an additional 10% to China. The election promise of a 10-20% universal tariff on all imported goods is still alive. The whole world is shaking at the sight of one of his SNS posts.

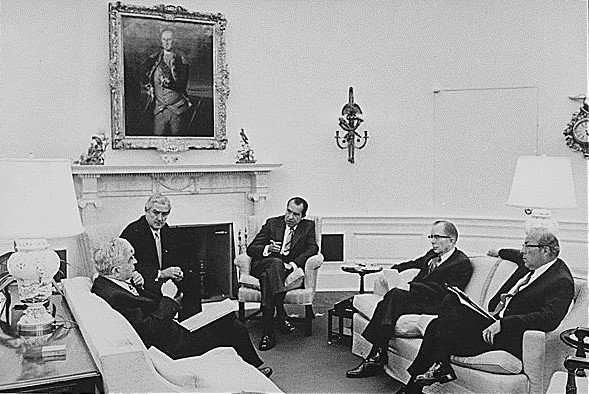

The U.S. president pledged to make the U.S. stronger and called for universal tariffs.It happened again before. This is Richard Nixon in 1971. It is interesting that Trump, who is famous as a fan of Nixon, is following Nixon’s policies from 53 years ago. An example of why Trump is obsessed with tariffs, nixon’s universal tariffTake a look into.

*This article is the online version of the Deep Dive newsletter published on the 29th.Subscribe to Deep Dive’s newsletter, ‘Economic news you’ll fall in love with as you read it.’

Strengthen the US, weaken the dollar

What is absolutely necessary for the United States to make its manufacturing industry great again, increase exports, and escape the trade deficit? According to President-elect Trump, it is indeed the ‘weak dollar’. Why? This is because a strong dollar is seen as a critical issue that reduces the export competitiveness of American products.he said this in an interview with Bloomberg last June:

“we are There is a big currency problem. ‘Strong dollar – weak yen, weak yuan’ The exchange rate problem is serious. I fought with them (when I was president) and they always wanted a weak currency. I fought by saying that if we kept the currency weak any longer, we would impose tariffs. “That (strong dollar) is a huge burden on American companies trying to sell tractors and other products to other countries.”

![Trump’s tariff bomb, a déjà vu of Nixon’s ‘universal tariff’ 53 years ago[딥다이브] Trump’s tariff bomb, a déjà vu of Nixon’s ‘universal tariff’ 53 years ago[딥다이브]](https://dimg.donga.com/wps/NEWS/IMAGE/2024/11/29/130534117.1.jpg)

The reason American products are not selling is not because of product competitiveness but because of the unfavorable exchange rate? It may make you shake your head, but this is a way of thinking that has been pretty entrenched since the late 1960s. at that time, the sharp decline in the U.S. trade surplus was attributed to Germany and Japan deliberately keeping their currencies low for exports.

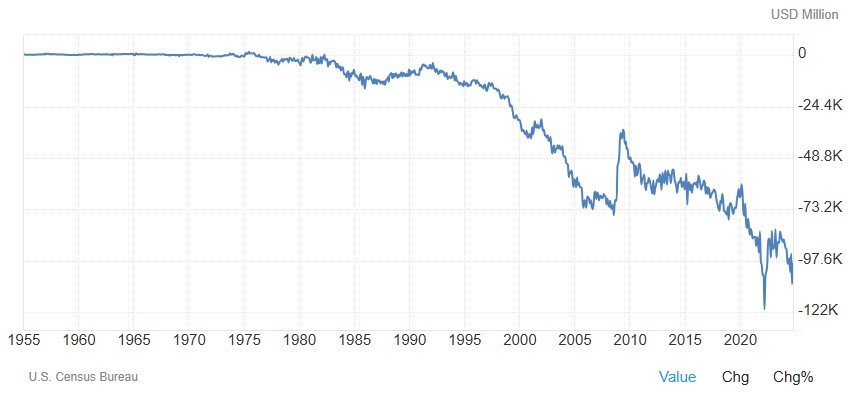

in 1971, the United States’ annual trade balance turned into a deficit for the first time since the 19th century.U.S. Treasury Secretary John Connolly reports to President Nixon on an economic stimulus plan to overcome the impasse. Among the measures, the famous Suspension of gold convertibility(When foreign countries brought in dollars, the United States stopped paying them by exchanging them for gold). Price and wage freezeThere was this. Additionally, this is included. every Temporarily imposes additional 10% tariff on imported goodsto do

When he first received this plan, President Nixon liked it very much. His remarks remain on tape in the White House Oval Office. “Import tariffs make me happy because they are a way to hit back and force concessions from other countries.” (Refer to the paper ‘The Nixon Shock 40 Years Later: Reexamining Import Surcharges’ by Douglas Irwin, professor of economics at Dartmouth College)

Tariffs are a popular policy with the public

A ‘universal tariff’, which imposes additional tariffs on all imported goods, has not been implemented in the United States as 1930. On Friday, August 13, 1971, key economic advisors attending a secret meeting chaired by President Nixon held at Camp David had a fierce debate over this. Some economists have pointed out the side effects of tariff increases. If imports decrease due to tariffs, the value of the U.S.dollar could rise further.

But treasury Secretary connolly argues that additional tariffs are effective in pressuring other countries into making concessions. He also emphasized that it would be politically popular in Korea as well.“For the American people, a border tax is easy to understand. “Taxes can change the exchange rate.” Ultimately,the participants agree on temporary additional tariffs as a bargaining chip to pressure the other country.

On the evening of Sunday, August 15, 1971, President Richard Nixon issued a famous special message that went down in history as the ‘Nixon Shock’. The key thing that shocked the world was the suspension of gold convertibility, but there was also an increase in tariffs.

“I want to go further to protect the dollar, improve our balance of payments, and increase American jobs. As a temporary measure, today I imposes an additional 10% tax on goods imported into the United Statesdo. This is Measures to ensure that U.S.products are not disadvantaged by unfair exchange ratesno see. “Once unfair treatment ends, so will import taxes.”

The tariff policy was again popular with the public. According to a poll at the time 71% of Americans favor additional tariffsI did. Onyl 14% disagree and 15% say they

It was a huge shock to our trading partners. Soon after, the U.S. Treasury imposed exchange rate adjustment requirements on each country. The demand was to devalue the U.S. dollar by 18% and, in particular, to appreciate the Japanese yen by 24%.

In short, the United States threatened other countries in this way. ‘Do you want to continue to be hit with 10% tariffs? Or do you want to increase the value of your currency by more than 18%?’ It’s like a gangster’s behavior. At that time, unlike now, it was a time when the government set the official exchange rate under a fixed exchange rate system. The United States thought that this threat would be easily accepted.

However, contrary to expectations, resistance from the other country was strong. Japan held particularly strong. By pouring a huge amount of foreign currency reserves into buying dollars, they tried to keep the value of the yen low in the foreign exchange market.

After about a month, when there was no progress in the negotiations, National Security Advisor Henry Kissinger stepped in. He was concerned that such stimulation would increase international tensions and led to retaliation from other countries.Though, President Nixon rejected Kissinger’s proposal to withdraw additional tariffs. “It’s difficult, Henry. (The tariff) is so popular in the country that we can’t finish it until we get something out of it. The people support this tariff. Oh my god, I can’t just give up.”

Nixon’s victory? defeat of the american economy

The United States has not given up and continues negotiations. on December 18, 1971, finance ministers from 10 countries gathered at the Smithsonian Museum in Washington, D.C. and reached an agreement. The value of the U.S. dollar against gold has been devalued by 7.9% (from $35 to $38 per ounce), the Japanese yen has appreciated by 16.9% against the dollar,and the German mark has appreciated by 13.5%. It’s the ‘Smithsonian Agreement’.

The Japanese government, which held out for a while, Domestic companies’ cries that ‘a revaluation of the yen is better than an additional 10% tariff’I had no choice but to accept it. Actually, this level of decline in the value of the dollar was already reflected in the foreign exchange market, even though it only meant that each country’s government made it official.

Having achieved his goal, President Nixon abolished the 10% additional tariff on December 21, 1971, two days after signing the agreement. the experiment of using universal tariffs as a bargaining chip came to an end after four months.

What was public opinion like? A Time magazine article at the time called the dollar devaluation achieved through the Smithsonian Agreement a “quiet victory.” “this is a win for Nixon and Connolly. “Their courage in risking devaluation earned the support of the public and politicians of both parties.”

By the way. Was this really a victory for the American economy? In the short term, it seemed like that. japan gave in to America’s demands for the appreciation of the yen, America ushered in the long-desired ’era of cheap dollars’, and President Nixon was re-elected by an overwhelming margin in November of the following year.Because I did it.

A combination of economic recession and high prices ‘Stagflation’This unfolds.

In 1976,it went into deficit again and has continued to be in deficit every year as.continues. Afterwards, the United States implemented a weak dollar policy (e.g., the Plaza Agreement in 1985), but was never able to escape from a trade deficit.

Let’s come back to the present and look at Trump’s policies. in an article posted on Truth Social on November 26, he said, “As soon as I take office on January 20 next year, An additional 25% tariff on all products from Mexico and Canada and a 10% tariff on China “until the invasion of fentanyl and illegal immigration stops.”I said I would do it. It targeted America’s 1st, 2nd, and 3rd largest trading partners all at once. Tariffs were weaponized in negotiations. The threat of ‘Will you take the tariffs, will you meet the demands?’ is very similar to Nixon’s policy 53 years ago.

In 1971, U.S. goods imports amounted to only 3.4% of GDP, but last year they increased to 12.7%.It amounts to. This means that the U.S. economy is highly dependent on imports and the impact of tariffs is notable. If we are not careful, American companies and consumers could be harmed.

Moreover, it is indeed unlikely that major trading partners will listen to threats. China already in 2018 When the first Trump term raised tariffs, the People’s Bank of Korea devalued the yuan, rendering the tariffs ineffective.I have been angry.A weaker yuan (i.e. a relatively stronger US dollar) than it is indeed now would also be the exact opposite of Trump’s wishes.

Of course, even if he knows all this, Trump will not easily let go of his weapon called tariffs. As he was already elected with ‘universal tariff’ as his election promise,he may expand his scope to other countries in the future. If only to get that country to the negotiation table.

And tariffs will work politically. The goal is the same, ‘Save American manufacturing and save jobs’, but how a Trump-style stick (tariffs) is more appealing to the public than a Biden-style carrot (subsidies)no see. The case of former President Nixon 50 years ago proves this. For reference, Trump is also a Nixon fan who has had a close relationship with Nixon since the 1980s (the two have very similar tendencies).

Recent opinion polls confirm this.In a public opinion poll conducted by CBS in mid-November, 52% of respondents responded positively to Trump’s tariff policy. In particular, 83% of voters who voted for Trump preferred it.I did it. No matter what economists say (UBS predicts that ‘if a 10% universal tariff is imposed, prices will rise by 1.7%’) and what can actually be achieved, tariffs are a good political weapon. As Paul Krugman said, bad economic ideas seem to refuse to die. The zombie idea of weaponizing tariffs is back in full swing. By. Deep Dive

there are still about 50 days left until the inauguration, but it seems like the entire global business community is talking about Trump. Will the tariff bomb really explode? To summarize the main points.

-Universal tariff applied uniformly to all imported goods. This is the only case of this being imposed in an advanced economy after World War II. Richard nixon, President of the United States, August 1971.

-At the time, the United States believed that the cause of the trade deficit was the strong dollar. So, after imposing a 10% universal tariff, we demanded that our trading partners devalue the dollar. After four months of negotiations, the goal was finally achieved with the Smithsonian Agreement.

-‘Weaponization of tariffs’ became politically popular, and Nixon was re-elected. However, as the devaluation of the dollar led to inflation, the U.S.economy suffered a serious recession. Now, President-elect Trump has once again brought out tariffs as a negotiating weapon. Why do bad economic policies survive rather than die?

*This article is the online version of the Deep Dive newsletter published on the 29th. Subscribe to Deep Dive’s newsletter, ‘Economic news you’ll fall in love with as you read it.’

Who is John Connolly’s wife and what is her background in Houston, Texas?

(John Connolly’s wife) in Houston, Texas. Trump, who was an accomplished businessman, interacted with Nixon, who was more then 30 years older than him, from the 1980s. the Nixon Presidential Museum also released a photo that Trump sent to Nixon when he was young in 2020. This photo was also shown at the exhibition at the time.

The historical context surrounding Nixon’s tariff policies and negotiations in the 1970s is important. The attempts to manipulate currency values through tariffs and other means reflect a broader strategy to address trade imbalances and bolster national economic standing. Nixon’s eventual withdrawal of the additional tariffs post-Smithsonian Agreement highlighted the complexities of international negotiations and domestic pressures, ultimately leading to a short-lived sense of victory that morphed into long-term economic challenges.

Fast forward to contemporary times,and Trump’s proposed tariffs mirror the mix of negotiation tactics pursued by Nixon.Both leaders aimed for economic outcomes that appealed to national interests, yet the potential consequences for domestic consumers and businesses remained a concern.The modern U.S. economy, with a much higher reliance on imports compared to the early 1970s, suggests that any similar strategies coudl trigger significant repercussions. The experience from Nixon’s era serves as a cautionary tale for today’s policymakers about the delicate balance required when using tariffs as bargaining tools in international trade.

while tariffs can serve as instruments of negotiation, they can also strain relationships with trading partners and lead to unintended consequences for the domestic economy. Such lessons are crucial for evaluating future economic strategies,particularly in an interconnected global market where the ramifications of policy decisions are felt far beyond national borders.