2025-04-02 11:42:00

Unpacking the Future of U.S. Customs Duties: $600 Billion and Beyond

Table of Contents

- Unpacking the Future of U.S. Customs Duties: $600 Billion and Beyond

- The Rise of Customs Duties as a Revenue Source

- Diverging Voices: Economic Analysts Weigh In

- Economic Realities and Long-term Implications

- The Calculation: Inflation and Tax History

- The Global Reaction: Trade Partners and the Fallout

- Public Sentiment and Political Knitting

- The Road Forward: Navigating Customs Duties and Economic Growth

- FAQ Section

- Final Thoughts: The Delicate Balance of Trade

- will Proposed Customs Duties Become a $600 Billion “Jackpot” for the US Economy? An Expert Weighs In

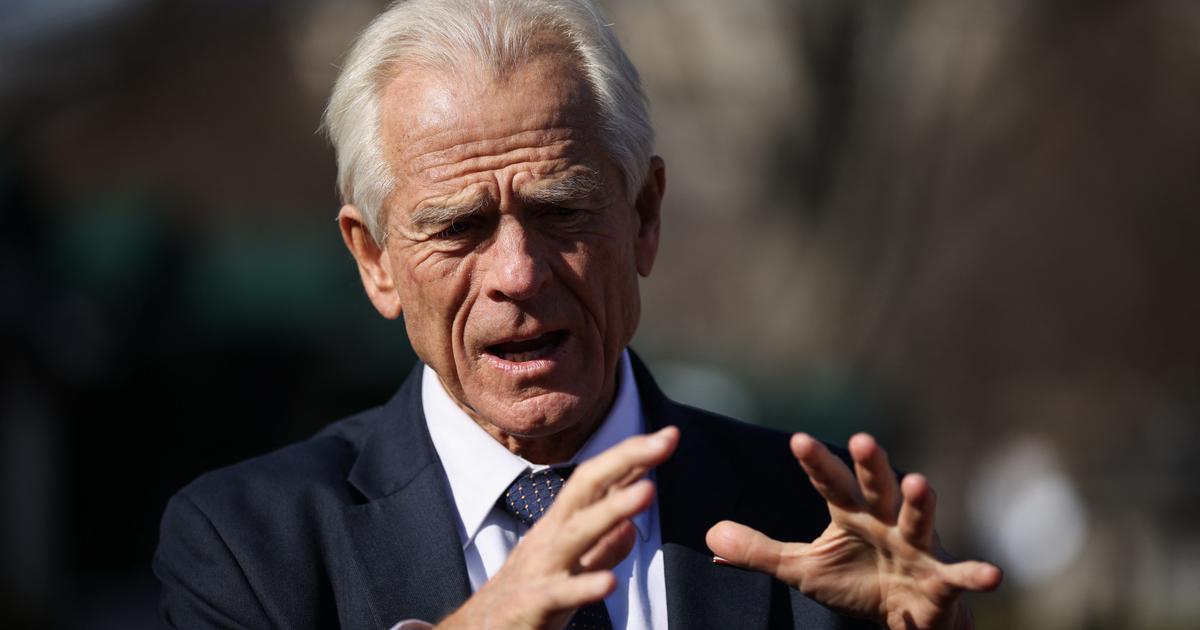

The notion that customs duties could become a “jackpot” for the U.S. economy is not merely speculative; it’s a bold assertion highlighted by Peter Navarro, a close advisor to Donald Trump. As the U.S. government prepares to unveil its strategic commercial offensive dubbed the “Day of Liberation,” the prospect of extracting $600 billion annually from customs duties beckons an intriguing discourse. But is this optimism unfounded, or does it signify a transformative pivot in American trade policy? Let’s dive deep.

The Rise of Customs Duties as a Revenue Source

Navarro’s vision is grand, envisioning a decade-long forecast of $6,000 billion ($6 trillion) stemming from customs duties alone. This could potentially redefine the revenue dynamics of the Federal Government, whose budget is projected at $6.75 trillion annually. With bold declarations on national security, job creation, and tax cuts, Navarro represents a belief that customs tariffs can be a cornerstone of a robust American economy.

The critical assumption here is the ability to collect $600 billion per year from tariffs. This belief stems from existing tariffs and the announcement of new taxes on imported cars, discussed by Trump earlier. These fiscal strategies aim to recalibrate the balance of trade by shielding American industries from foreign competition. However, skepticism exists regarding the methodologies behind Navarro’s calculations.

Diverging Voices: Economic Analysts Weigh In

Contrasting with Navarro’s enthusiastic projections are several economic analysts and institutions that portray a less rosy outlook. For instance, François Villeroy de Galhau, governor of the Banque de France, highlighted that the trade war led by Trump might prompt an economic downturn rather than growth. He referred to it as a “goal against field,” warning that the U.S. could find itself grappling with a recession rather than thriving under elevated tariffs.

The Danger of Isolationism

This brings to the forefront critical discussions on the ramifications of adopting isolationist trade policies. When American corporations face increased costs due to tariffs, there may be a cascading effect: higher prices for consumers, potential job losses in industries reliant on imports, and strained relations with international partners.

Economic Realities and Long-term Implications

Examining the economic landscape, the ramifications of introducing extensive tariffs lead us to assess industries that may be adversely affected. For example, the automotive industry— a critical pillar of the American economy—could face exorbitant input costs, affecting not only manufacturers but the workforce as well.

Case Study: The Automotive Industry

Consider the automobile sector: should car manufacturers face added tariffs, the price of vehicles could surge, deterring consumer purchases and potentially leading to an economic slump in a sector that employs millions. A troubling paradox emerges: while tariffs aim to protect jobs, they may inadvertently put the very jobs at risk that they seek to protect.

The Calculation: Inflation and Tax History

Navarro’s claim further prompts scrutiny concerning historical tax increases in the U.S. Speaking to CNN, he suggested that even adjusted for inflation, the expected tariff revenue would far exceed historical peaks, such as the tax hikes of 1942 during World War II. However, these comparisons raise necessary questions about economic contexts: wartime taxation was implemented under unique domestic and international pressures, a reality starkly different from current trade negotiations.

Understanding Inflation in Contemporary Terms

As inflation remains a significant concern in today’s economy, how tariffs interact with consumer buying power introduces another layer of complexity. If tariffs increase prices, while wages remain stagnant, the average consumer will have less spending power, complicating the purported benefits of increased government revenue.

The Global Reaction: Trade Partners and the Fallout

With the prospect of high tariffs, global partners are watching closely—and responding. Countries traditionally dependent on U.S. exports may impose retaliatory tariffs, squeezing American companies further. The recent patterns witnessed in the trade disputes reveal a cycle of escalating tariffs leading to diminished exports and possibly, a global trade recession.

International Business Case Examples

For instance, when steel and aluminum tariffs were imposed in 2018, American manufacturers faced backlash internationally, yielding significant consequences for businesses reliant on these materials. Companies like Whirlpool, a U.S.-based appliance manufacturer, faced higher operational costs and supply chain disruptions due to increased prices on imported metals. Such reactions underscore the interconnected nature of today’s global economy.

Public Sentiment and Political Knitting

As trade policy changes affect the American populace, public sentiment remains a fluctuating but vital aspect of political maneuvering. According to recent surveys, while some in the manufacturing sector celebrate the proposed tariffs, others express concern about rising costs and potential job losses.

This divide underscores a broader conversation: can politicians effectively convey the complexities of trade impacts to their constituents while mitigating fears of economic hardship?

Political Implications of Trade Policy Shifts

As seen in the past year’s elections, U.S. voters are increasingly siding with candidates who advocate for relaunched trade policies. This illustrates the political stakes tied to trade negotiations. However, promising economic uplift from customs duties requires careful orchestration to avoid backlash should the anticipated benefits fail to materialize.

Navigating the proposed customs duties situation necessitates a balanced approach that accounts for the intricacies of domestic and international relations. Ensuring that fiscal policies uplift American industries without jeopardizing consumer well-being is paramount.

Expanding investment in workforce education and technological advancements could allow domestic industries to better compete internationally, potentially alleviating the pressures of tariffs.

Innovative Solutions for a Competitive Edge

Exploring innovation as a solution rather than relying solely on tariffs could propel economic growth. Investing in renewable energy technologies or infrastructure can create new jobs while minimizing dependence on foreign entities. For example, programs supporting clean energy initiatives could enhance sustainability while fostering new sectors within the economy.

FAQ Section

What are the potential impacts of a $600 billion annual revenue from customs duties?

If successful, such revenues could drastically alter federal funding models and allow for increased public investments. However, they may also lead to higher consumer prices and strained international relations.

How do customs tariffs affect American consumers?

Increased tariffs on imported goods can lead to higher prices, impacting consumer purchasing power and potentially leading to inflationary pressures.

What are some historical precedents for tariffs in the U.S.?

Notable historical precedents include the tariff hikes of 1942 to fund World War II, which were enacted under drastically different conditions than those faced today.

Final Thoughts: The Delicate Balance of Trade

The road ahead is replete with challenges and opportunities as the U.S. government version of “Day of Liberation” unfolds. While aspirations for tariff-induced revenue streams tantalize, a nuanced understanding of economic repercussions remains imperative. It is essential for policymakers to consider global interdependencies, domestic consequences, and the long-term vision if America is to harness the full promise of its customs duties.

Join the Conversation

What are your thoughts on the proposed tariffs and their expected benefits? Share your insights in the comments below!

will Proposed Customs Duties Become a $600 Billion “Jackpot” for the US Economy? An Expert Weighs In

Time.news: The U.S. government is reportedly considering a significant shift in trade policy,possibly generating $600 billion annually through customs duties. Peter Navarro,a former advisor,has described it as a potential “jackpot” for the U.S. economy. But is this achievable, and what are the potential downsides? We spoke with Dr. Anya Sharma, a leading trade economist and professor at the University of California, Berkeley, too get her expert viewpoint.

Time.news: Dr. Sharma, thanks for joining us. Let’s start with the headline figure: $600 billion a year from customs duties.is this realistic?

Dr.Anya Sharma: While theoretically possible, achieving $600 billion annually from customs duties relies on several crucial assumptions and would require a radical overhaul of current trade relationships. It hinges on the U.S. considerably increasing tariffs on imports, which would inevitably invite retaliatory measures from other countries. The long-term effect on the economy is questionable.

Time.news: The article mentions that this revenue could redefine the Federal Government’s budget.How might this impact areas like national security, job creation, and tax cuts, as some proponents suggest?

Dr. Anya Sharma: In theory, a significant influx of revenue could fund initiatives in those areas. However, that comes with major caveats. Increased customs duties lead to higher prices for consumers.This reduces purchasing power and can stimulate demand for wage increases. Secondly, while some industries might see a short-term boost from reduced foreign competition, others reliant on imported materials would suffer. It will be really challenging for policymakers to determine if this provides more benefits than detriments. This can lead to job losses and hinder economic growth. The envisioned benefits are far from guaranteed.

Time.news: The article also raises concerns about economic analysts predicting potential economic downturns due to trade wars. Could isolationist trade policies backfire?

Dr. Anya Sharma: Absolutely. Isolationist trade policies, driven by high customs duties, can trigger a chain reaction. Other countries will likely retaliate with their own tariffs on U.S. exports. This reduces the global demand for U.S. products. resulting in diminished exports and creating a climate of economic uncertainty. This can easily lead to a trade war, with negative consequences for all parties involved. It’s a dangerous game.

Time.news: The automotive industry is highlighted as a sector particularly vulnerable to increased tariffs. Can you elaborate on why that is?

Dr. Anya Sharma: The automotive industry operates on a complex, global supply chain. U.S. car manufacturers rely heavily on imported components. If tariffs increase the cost of these components, the price of vehicles will inevitably rise. This could deter consumers, lower sales, and again, potentially lead to job losses within the automotive industry and related sectors. The industry will be in a slump and will need to make major changes.

Time.news: The article compares the potential revenue from these tariffs to historical tax increases, such as those during World War II. Are such comparisons valid?

Dr. Anya Sharma: Comparing current trade proposals to wartime taxation is misleading. The economic context is vastly different. Wartime taxation was a temporary measure implemented under exceptional circumstances.The economic situation today is far more complex, and the globalized nature of trade means that the consequences of high customs duties would be felt far more widely and acutely.

Time.news: Inflation is a major concern for many people. How might increased tariffs affect inflation and consumer spending power?

Dr. Anya Sharma: Increased tariffs directly translate to higher prices for imported goods, which contributes to inflation. If wages don’t keep pace with these price increases, consumers’ purchasing power diminishes. This also reduces consumer spending, slowing economic growth, and potentially leading to a recession. It is a slippery slope that will need to be handled with care to have the best results.

Time.news: What about the response from our trade partners? The article references the steel and aluminum tariffs from 2018. What lessons can we learn from that experience?

Dr. Anya Sharma: The 2018 steel and aluminum tariffs offer a cautionary tale. While designed to protect domestic industries, they led to retaliatory tariffs from other countries, hurting American manufacturers who relied on those materials.Companies like Whirlpool faced increased operational costs and supply chain disruptions.This experience demonstrates the interconnectedness of the global economy and the potential for unintended consequences.

Time.news: The article suggests that alternatives to tariffs, such as investing in workforce education and technological advancements, could be more beneficial. do you agree?

Dr. Anya Sharma: Absolutely. Investing in innovation, education, and infrastructure is a far more sustainable approach to enhancing American competitiveness. Supporting renewable energy technologies,such as,creates new jobs,reduces reliance on foreign entities,and fosters long-term economic growth. These strategies allow for long-term strategic growth, giving people a sustainable advantage, instead of quick solutions.It is indeed the only way to proceed properly.

Time.news: Dr. Sharma, what’s your final piece of advice for our readers looking to understand these potential changes to customs duties?

Dr. Anya Sharma: Stay informed and be skeptical of overly optimistic projections. The issue of customs duties is complex and multifaceted. Consider the potential impacts on your own industry and your purchasing power, and engage with your elected officials to voice your concerns and opinions. Understanding the big picture will help you best understand the possible changes.

Time.news: Dr. Sharma, thank you for sharing your expertise and insights with us.