Samdar Barber Tsadik CEO of the International Bank (photo by Magma Images, Tamar Matzafi)

The growth trend in the international reports for 2022 is evident in all areas of the bank’s core activity according to the summary report for the fourth quarter and the entire year. Credit to the public increased by 14.7% in 2022 and amounted to NIS 117.156 million. The growth in credit is done while maintaining a proportionate and significant risk In all areas of activity: business credit grew by 22.7% in the past year, and household credit and housing loans grew by 7.6%. Public deposits grew by 9.7% compared to the same period last year and amounted to NIS 168.269 billion.

The financial profit from current activity increased in 2022 by 41.2% and amounted to NIS 4.016 billion. The increase is explained by the effect of the increase in the volume of business activity, the effect of the increase in shekel and dollar interest rates and the effect of changes in the index. Fee income increased by 3.1% compared to 2021 due to an increase in the bank’s activity.

More in-

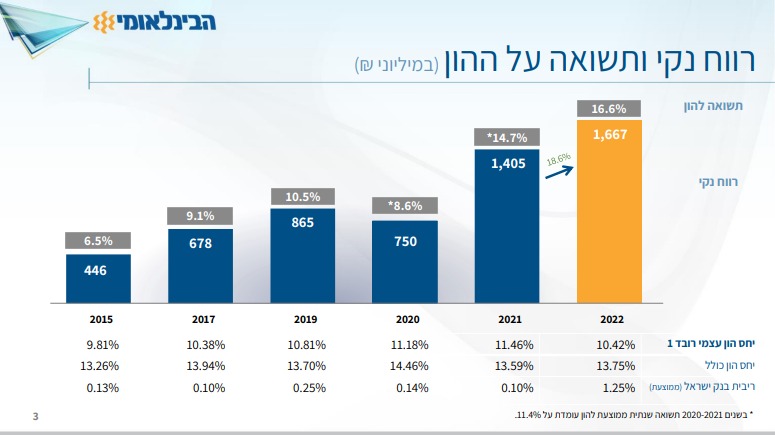

The net profit of the International Group in 2022 amounted to NIS 1.667 million, an increase of 18.6% relative to the corresponding period last year. Return on capital -16.6%. In the fourth quarter, the net profit amounted to NIS 536 million, an increase of 61% relative to the corresponding period last year. The return on capital reached 20.7%.

Expenses for credit losses in 2022 amounted to 123 million shekels (a rate of 0.11%) compared to income of 216 million shekels in 2021, an increase of 339 million shekels, resulting from an increase in the group provision for credit losses. In 2022, expenses were recorded resulting from an increase in the group provision in the amount of NIS 168 million due to an increase in the scope of normal credit, and from an increase in the subjective provision resulting from increasing the cushions for possible consequences as a result of changes in the local and global economic environment.

In the fourth quarter, the expenses for credit losses amounted to NIS 49 million compared to an income of NIS 10 million in the corresponding period last year. A decrease in the volume of problematic credit in 2022 at a rate of approximately 22.7% compared to the end of 2021.

The bank’s board of directors approved today the distribution of a dividend at a rate of 50% of the net profit, in the amount of NIS 268 million. In 2022, dividends totaling NIS 945 million were distributed. The annual dividend yield as of December 31, 2022 reached 6.82%, the highest dividend yield in the system.

Samdar Barber-Tsadik, CEO of the International Group: “The 2022 reports of the International Group reflect growth and efficiency while maintaining high financial stability. The international shows an increasing trend in margins that results from continued growth in the variety of the bank’s activities, both in credit – where an impressive growth is evident while maintaining proportionate risk, growth that moderated in the fourth quarter mainly against the background of a decrease in demand, and in the areas of managing customer funds while expanding capital market activity. The rising interest rate trend in Israel and in most of the world, after many years of operating in a zero interest environment, also contributed to the bank’s profitability. The International focuses its value propositions on customers in accordance with the new interest rate environment, with the aim of offering them unique and worthwhile investment instruments that include diverse deposits and activity in the capital markets in Israel and around the world.”

She further said: “The bank recently approved the corporate strategy for the years 2023-2025, a plan whose purpose is to move the bank forward in the developing competitive environment. The plan emphasizes growth while providing added value to customers according to their needs, including in the digital and technological fields. Another emphasis in the plan is on continuing to lead In the capital market and private banking, along with continued development and innovation in the field; an important emphasis is on leading optimization moves and exposure to new areas within collaborations and advanced use of data to provide optimal and personal services to the client, as well as on adapting the branching system to the new digital world.”

Comments to the article(0):

Your response has been received and will be published subject to the system policy.

Thanks.

for a new comment

Your response was not sent due to a communication problem, please try again.

Return to comment