Alrov owns 15% of the shares of Clal Holdings, the parent company (100%) of Clal Insurance, and through a holding permit it received and seeks to transfer to control by purchasing another similar portion of shares. At the same time, Akirov is fighting against the agreement according to which Clal Holdings will purchase the MAX credit card company for NIS 2.4 billion. Akirov told “Calcalist” today that “this deal will not happen. I will not let it happen”, and goes on the attack against Haim Samet, chairman of Clal Insurance, who was appointed to the board on his behalf, claiming: “I made a mistake when I appointed him a director on my behalf. He will not continue another term and will be dismissed in the general assembly in a month.”

The valuation of the assets contributed to the profit: Meanwhile, in its main field of activity, real estate, Alrov’s business is being conducted in a positive manner. The company that owns profitable real estate activities of offices and hotels has benefited from the boom in tourism and hotels in the last year, and it ended the third quarter with a net profit of 158.5 million shekels, compared to 52.3 million shekels in the corresponding quarter. The bulk of the profit is attributed to the upward revaluation of three of the company’s income-producing properties in Israel, in Jerusalem and Tel Aviv, which resulted in an increase in the fair value of NIS 162 million. Alrov performs valuations in December every year, but this year was earlier due to the increase in inflation and interest and the effect of the increase in the index on rents. “Our rents are linked to the increase in the index so that we are not affected by inflation,” said Akirov.

1 Viewing the gallery

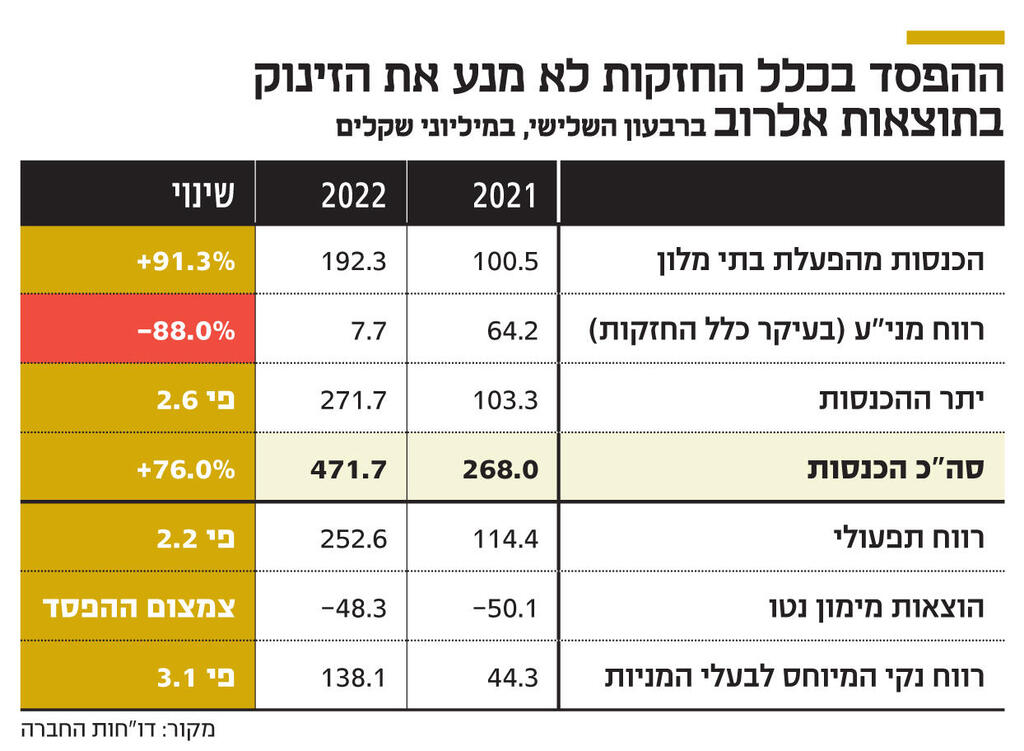

The loss in general slips

While the rental income in its office buildings is relatively static, a serious boost was recorded in the hotel sector. The company has two luxury hotels in Jerusalem, Mamilla and David’s Citadel, and hotels in London, Paris and Amsterdam. The hotel sector brought in NIS 192 million in the third quarter compared to NIS 100 million in the corresponding quarter, and in the first nine months the revenues stood at NIS 479 million compared to NIS 167 million in the corresponding period. However, Alrov recorded a loss of NIS 203 million in January-September this year on its real estate portfolio, most of which consists of shares in Clal Holdings (NIS 675 million) and Bank Leumi (0.6%), whose value was NIS 96 million.

The value of the shares of Clal Holdings decreased by an additional NIS 21 million from the end of September, while the value of Leumi shares increased by NIS 4 million. Alrov, whose value was cut to NIS 1.5 billion in March 2020, due to the effect of the corona restrictions on its hotels, has recovered and is currently trading at a value of NIS 4.2 billion. However, about a year ago Elrov was already traded at a value of NIS 4.8 billion. Ikorev says that the group’s hotels are in their best period and profitability rates are higher than before the corona.

Clal Holdings shares have recorded a 20% drop since mid-September and are currently trading at a value of only NIS 4.3 billion, a drop that resulted in a provision of NIS 200 million in Alrov’s reports. A significant part of the drop in value is also attributed to the MAX transaction, and according to Akirov, “on the day of the announcement of After the deal, the stock fell by 7%, and when we announced that we would fight the deal in court, the stock rose by 2.7%. Everyone understands that the deal is wrong and there are many question marks as to why it was done. If we take Ishchart, it trades at 70% of the capital and they bought MAX, they wanted to buy because I won’t let them buy, at 1.6 on the capital. Ishchart is a much better company than MAX.”

Not everyone will agree with this. MAX is more profitable and with growth potential.

Akirov: “There is a big question mark as to why they did the deal. What do the directors even have? A salary. No one there invested a dime. I invested NIS 700 million in the shares of Clal Holdings, and I have no loss from the deal. What is the interest of all the directors anyway? To receive a salary and maintain The chair. They don’t want a landlord. Not someone to rule. Because they understand what will happen there and that most of them won’t stay. They don’t even understand money. I put Samet in as chairman so that he can keep the company and in the end he keeps his chair. In a month there is a general meeting and we will make sure that he is not elected again. Samet is the chairman who has done the most damage to the company. I will inform everyone that he does not represent me. You will notice that there is another director in the company, named Yair Bartov, who said that the MAX deal must be approved quickly before Akirov brings in his directors.”

You are only 15% of the company. How will you care?

“Do you think the other shareholders don’t understand what’s going on? The only company that doesn’t distribute dividends among the insurance companies is Clal. The Phoenix, Harel and Menorah make money and distribute. My representatives to the board of directors, David Granot and Aharon Fogel, are people with experience in finance companies. Granot managed four banks Vogel sat for more than ten years in Migdal as chairman. These are people who understand money.”

Don’t forget Samet was your appointment.

“Samet is a big mistake of mine. When I appointed him, he said fine, fine, fine, and in the end he got a position and he doesn’t understand money. To be a defense minister in the State of Israel without understanding security is not brave? Also to manage Clal. I will not become defense minister because I I don’t understand security. Nor will I manage Clal Insurance. This is outrageous. It’s a fact that the only insurance company that doesn’t make a profit at all. The Phoenix make the investments perfectly. They choose the company to invest in according to the management. Clal Holdings don’t know how to manage Clal Insurance, so you MAX Will they know how to manage? This is reminiscent of Teva. They bought a large company and where are they today? Is it Eli Horowitz’s Teva? We asked to oust Samet. The Securities and Exchange Authority is doing an investigation on Clal.”

You say the MAX deal won’t go through. But it depends on the approval of the Bank of Israel. who can give permission even without your consent.

“This deal cannot come to fruition. No one wants to destroy the company except the managers.”

What will you do if the Bank of Israel asks to do due diligence on the transaction?

Akirov clarifies that he will not appear for the Bank of Israel’s due diligence on the control of MAX as the largest shareholder in all holdings and will not apply for such a permit, which requires his approval. In the insurance rule, they claim that the transaction can be approved and then legally required to obtain a permit because there is only one shareholder. “I’m not ready to go through the Bank of Israel’s inspections for the transaction,” said Akirov, “I did it when they gave me a maintenance permit for Clal Insurance. I didn’t buy an insurance company to have a credit card. Clal Insurance holds a 6.5% guarantee from Mischerhart, which trades at 70% of the capital and buys MAX by 150%? They are the largest shareholders in Israchart and have to sell in order to buy MAX. The Bank of Israel cannot do me a fit and proper without my asking. I hope besides that in the State of Israel there are courts. If they go to court and get an order against me I have to Going through the process is something else. On December 27 there is a Clal Insurance shareholders’ meeting to elect a new board of directors and there everything will be clarified.”

You currently do not receive a control permit, among other things due to reasons of over-centralization.

“I will get a control permit. There is no reason not to. I have no problems behind me. Of course the management of Clal is against me. There are problems that have no solution. If you are bankrupt or criminally listed, you cannot buy an insurance company. My problems are solvable. Problems of capital and three companies We are in talks with the regulator and will resolve them.”

Why do you insist on buying Clal despite all the difficulties?

“In retrospect, you’re right. But I’m already inside. So will I throw away NIS 700 million? The value of the shares has dropped by NIS 200 million, are there donkeys on the street who will now come to buy? So should I lose money and give them a reward for continuing to run the company?”

Election results are not really in your favor, as someone who holds other positions.

“There are elections, the people chose and we should continue with it. This is what the majority chose and that is what will happen. It is not that a dictatorship arose here. There were elections, these are the results and I hope they will be good enough and then maybe they will give them another four years. I am not a political person and do not take part in politics”.

Issued the company in Switzerland.

“We are building a 100,000 square meter office building there. I really like it, so I travel every week to Europe. When I’m here, I like to follow the construction from here as well. So I installed a camera in front of the building and I’m following through the phone to see how it’s progressing.”

Clal Insurance Company stated: “Clal Insurance Company does not usually confront its shareholders in the media, but prefers to act responsibly towards the company and discuss all the issues on its agenda, in the appropriate places and in the appropriate forums, in accordance with the rules of proper corporate governance.”